The Nasdaq has begun to exhibit early signs of direction change as it successfully breaks through the resistance of the bearish channel on the 1-hour time frame. This breakout serves as a significant signal that the pressure from sellers is waning, while buyers are starting to regain momentum. The price movement that emerged from this bearish structure during the US session indicates a transition towards a more stable bullish phase, reflecting a shift in market sentiment in the short term.

Support for potential upward movement can also be observed from various technical indicators that align to favor the bullish outlook. The rising Moving Average, the formation of higher highs in the ZigZag pattern, and the strengthening MACD in the positive zone all indicate that buyers now hold stronger control. As long as the price remains above the breakout level, there is ample opportunity for the rally to continue, paving the way for the market to approach the next resistance.

Recommended

Recommended

Recommended

Recommended

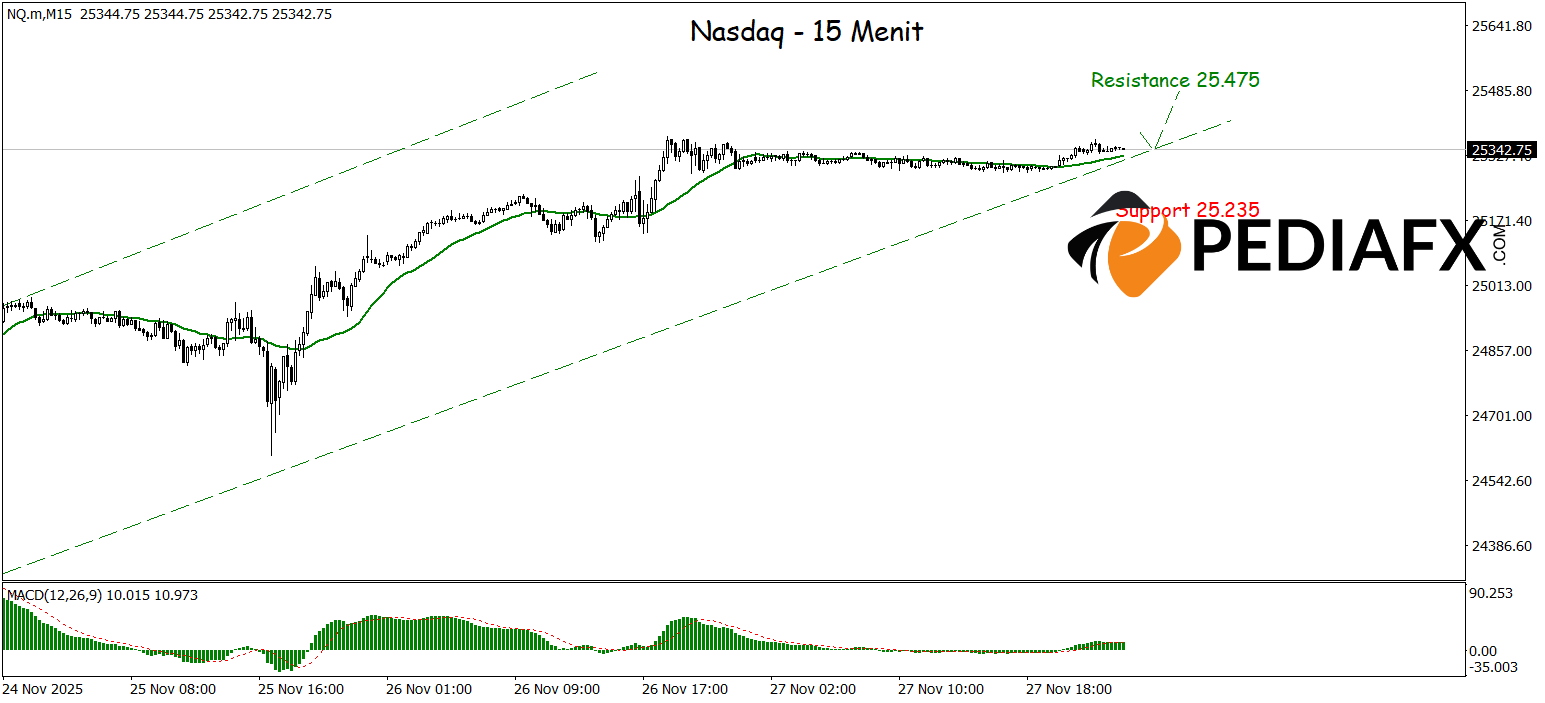

On the 15-minute time frame, the bullish structure appears to be increasingly solid, characterized by the formation of an upward channel accompanying the price movement. The consistently strengthening MA and a stable MACD in the positive zone provide additional confirmation that the short-term momentum is favoring buyers. With this consistent technical dominance, there lies a possibility for the Nasdaq Composite to continue rising and test the significant resistance around 25,475.

Technical Reference: buy as long as above 25,235

Potential Take Profit 1: 25,425

Potential Take Profit 2: 25,475

Potential Stop Loss 1: 25,2275

Potential Stop Loss 2: 25,230