On the 1-hour chart, the EURUSD uptrend remains solid, indicating that the potential for a bullish rally is not yet fully exhausted. Currently, the price is in a consolidation phase, forming a continuation pattern known as a descending triangle. The highs and lows have not been convincingly broken, which reflects a market awaiting a catalyst. A breakout from either side of this pattern could trigger further movement with increased volatility.

From a technical perspective, the slightly declining Moving Average (MA), still leaning towards bullish trends, suggests that the upward trend has not lost its direction. The ZigZag indicator continues to display an uptrend structure while the CCI indicator rising from the oversold area signals a resurgence in buying interest. This combination of signals opens up opportunities for EURUSD to continue its upward trajectory, as long as the price can break out from the consolidation pattern and maintain the existing bullish trend.

Recommended

Recommended

Recommended

Recommended

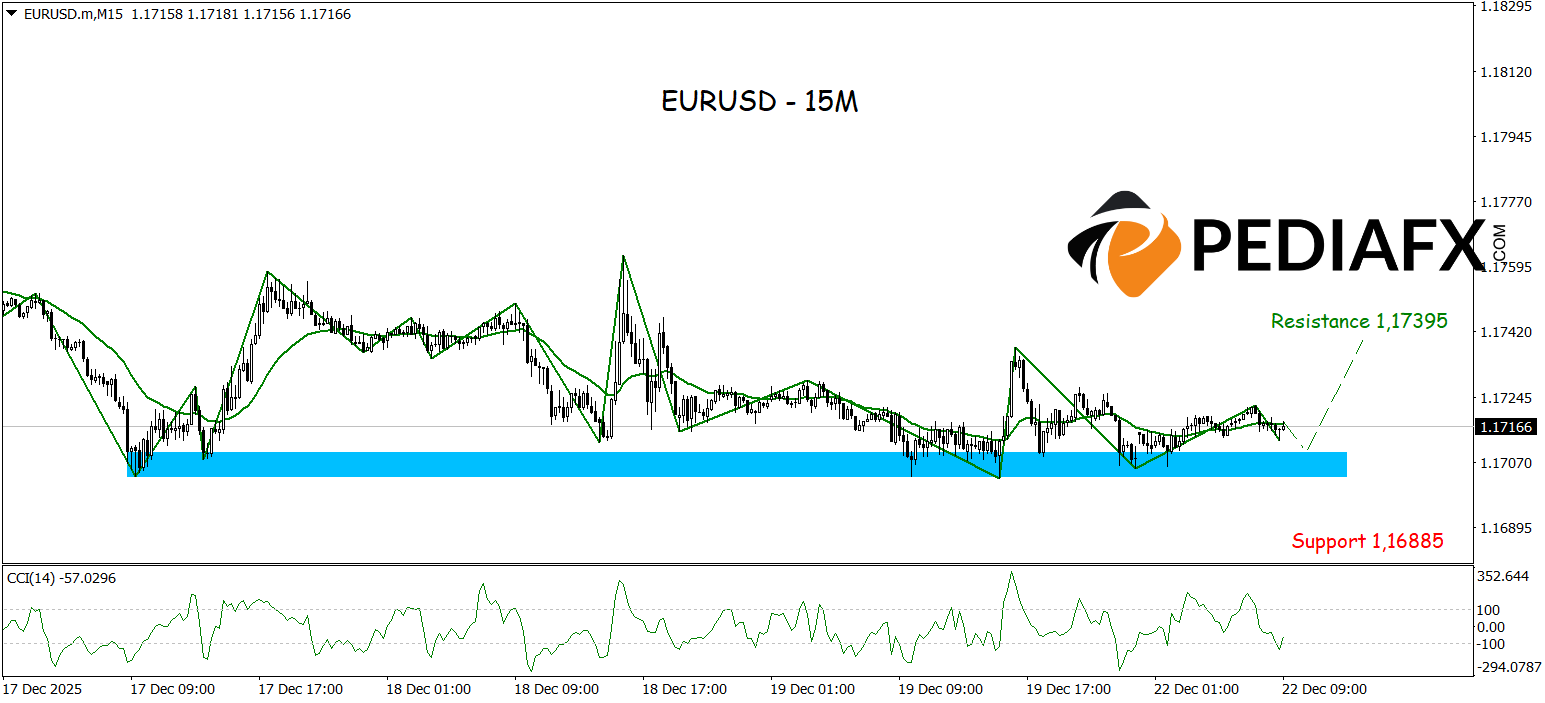

Currently, EURUSD is being held at a strong support area (blue dashed line) which has yet to be convincingly breached, creating a chance for a rebound from this low range. Technical support signals are evident from the ZigZag forming a low level and the CCI indicator showing oversold conditions, indicating that the potential for further declines may be limited while buying interest could be on the rise, allowing the EURUSD a chance to move upward toward testing the resistance area at 1.17395, as long as the main support holds firm.

Technical Reference: buy above 1.16885

Potential Take Profit 1: 1.17300

Potential Take Profit 2: 1.17395

Potential Stop Loss 1: 1.16980

Potential Stop Loss 2: 1.16885