The EURUSD pair on the 1-hour chart is still operating within a well-maintained bullish channel. Although the current price movement appears to be sideways, this consolidation phase has not altered the prevailing bullish structure. The dominance of buyers is clearly evidenced by the continued formation of the higher high – higher low (HH–HL) pattern, indicating that buying pressure remains the primary catalyst for price movement.

From a technical perspective, the Moving Average (MA) appears to be flattening, yet it still trends upward, confirming that the short-term bullish trend is intact. Additionally, the ZigZag is continuing to create an uptrend sequence, affirming the temporary nature of the corrections that have occurred. Meanwhile, the CCI is in the oversold territory, signaling a potential price bounce in the near future, thus keeping the path for an upward move in EURUSD open as long as the price stays within the bullish channel.

Recommended

Recommended

Recommended

Recommended

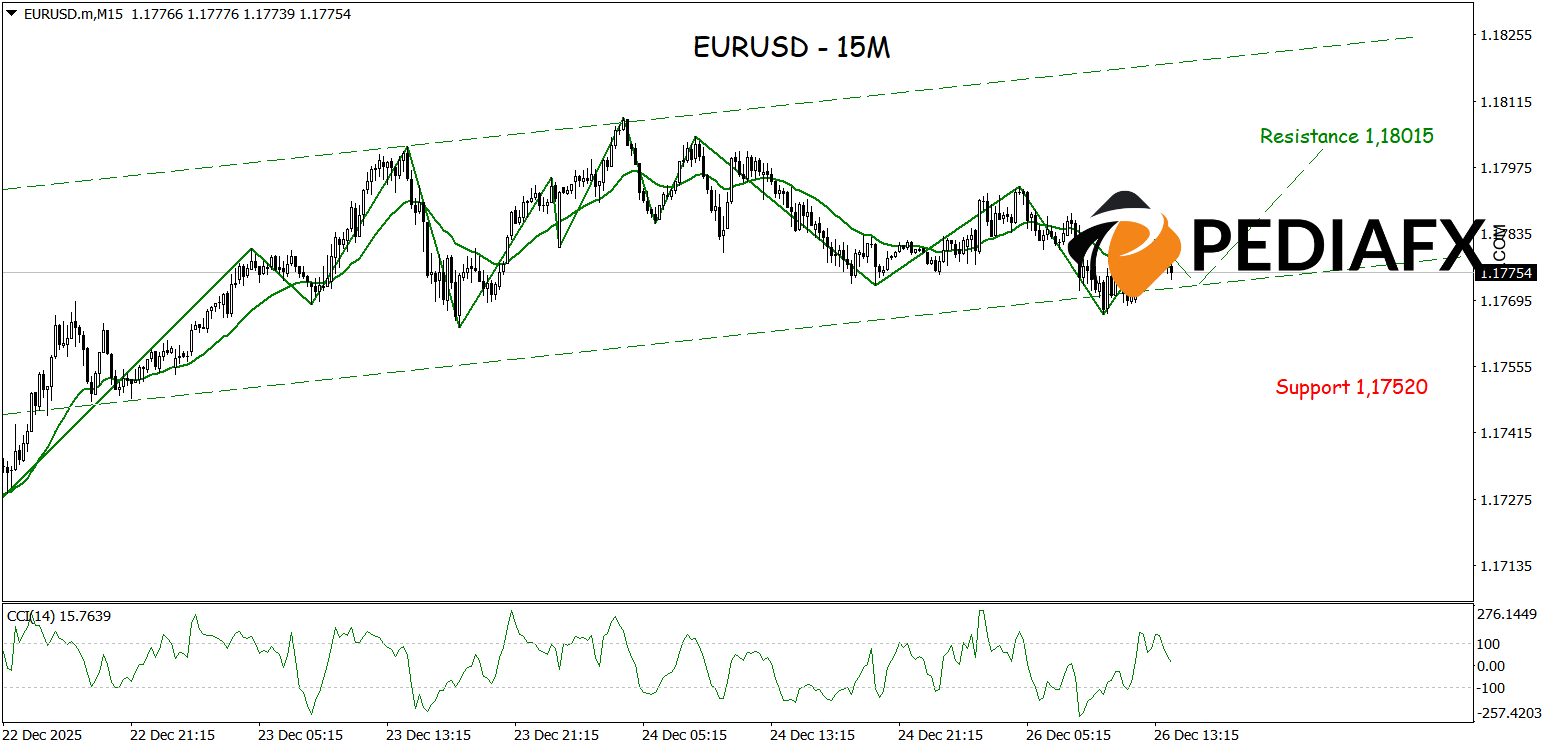

On the 15-minute chart, the EURUSD also shows further bullish prospects, as the Moving Average (MA) trends upward and the ZigZag continues to build on the bullish structure. In addition, the CCI being in the oversold region indicates potential for a price rebound, which supports short-term upward movement. Given these conditions, EURUSD is currently attempting to test the resistance level at 1.18015, and as long as buying pressure remains strong, the chances of breaking above this level remain promising.

Technical Reference: buy above 1.17520

Potential Take Profit 1: 1.17935

Potential Take Profit 2: 1.18015

Potential Stop Loss 1: 1.17610

Potential Stop Loss 2: 1.17520