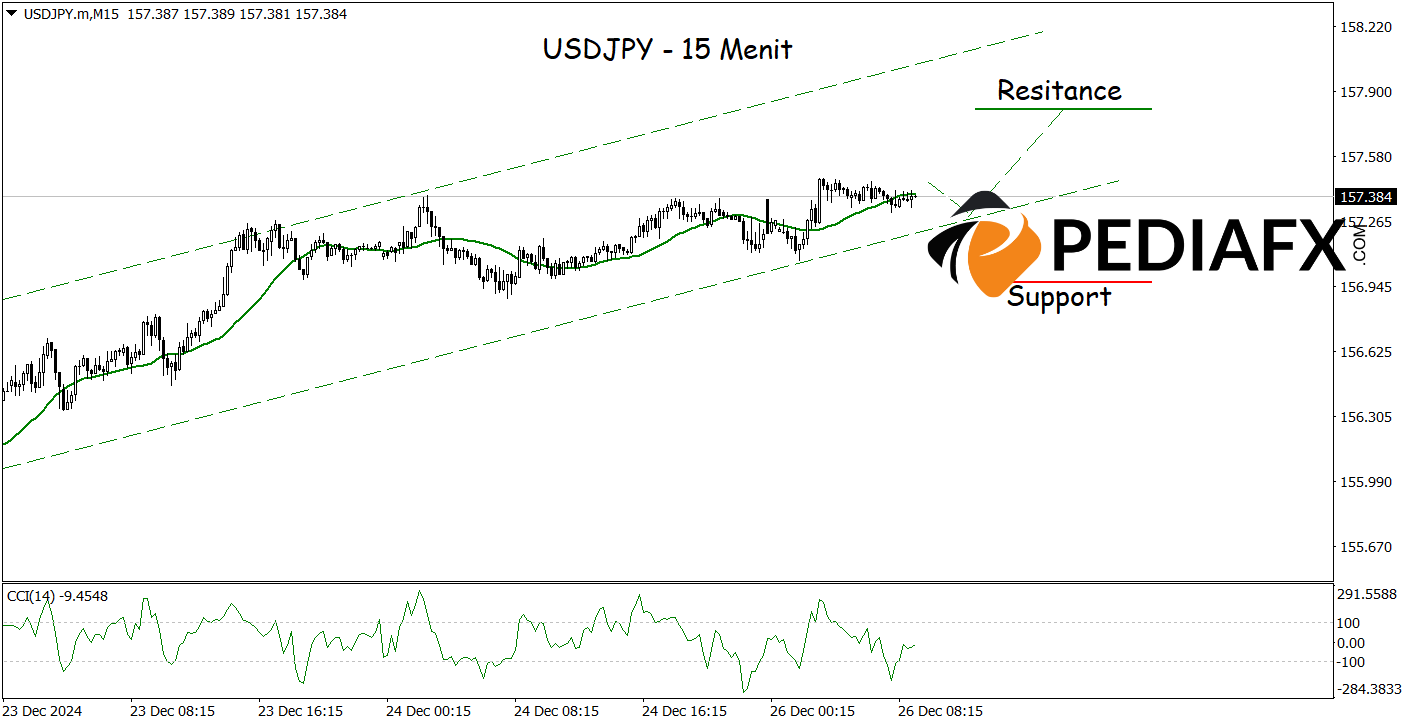

The USDJPY currency pair is showcasing strong upward potential as the price movements remain within a defined upward channel. This trend is further bolstered by key technical indicators such as the Moving Average (MA) and the MACD (Moving Average Convergence Divergence), both of which are signaling positive momentum.

The MA indicator indicates that the price is trading above the moving average line, suggesting that bullish momentum is currently prevailing. Furthermore, the MACD supports this positive trend; its line remains above the signal line, while the histogram stays in the positive territory.

Recommended

Recommended

Recommended

Recommended

Moreover, the analysis of the one-hour chart is consistent. The 15-minute chart shows an upward opportunity as the price is situated within the upward channel, with the CCI bouncing back from the oversold region, further enhancing the upside potential for USDJPY. Should this scenario play out, there is a good chance that USDJPY could rise to test the resistance level of 157.820.

Technical Reference: buy as long as it remains above 156.980

Potential Take Profit 1: 157.680

Potential Take Profit 2: 157.820

Potential Stop Loss 1: 157.140

Potential Stop Loss 2: 156.980