According to the recent technical analysis, USDJPY is on an upward trajectory and demonstrates a robust bullish trend, supported by the bullish channel that consistently bolsters price movements upwards. In recent trading sessions, USDJPY has successfully maintained its positive momentum, and the technical indicators suggest a strong possibility for continued upward movement.

The Moving Average (MA) indicator clearly signals a bullish outlook, as its line sits below the current price. This positioning reinforces the dominance of the upward trend and instills confidence among traders to initiate buy positions. Additionally, the Stochastic indicator is also showing favorable signals, as its values are positioned in the oversold region and are beginning to rise. This phenomenon indicates a potential for higher price movements in the near term.

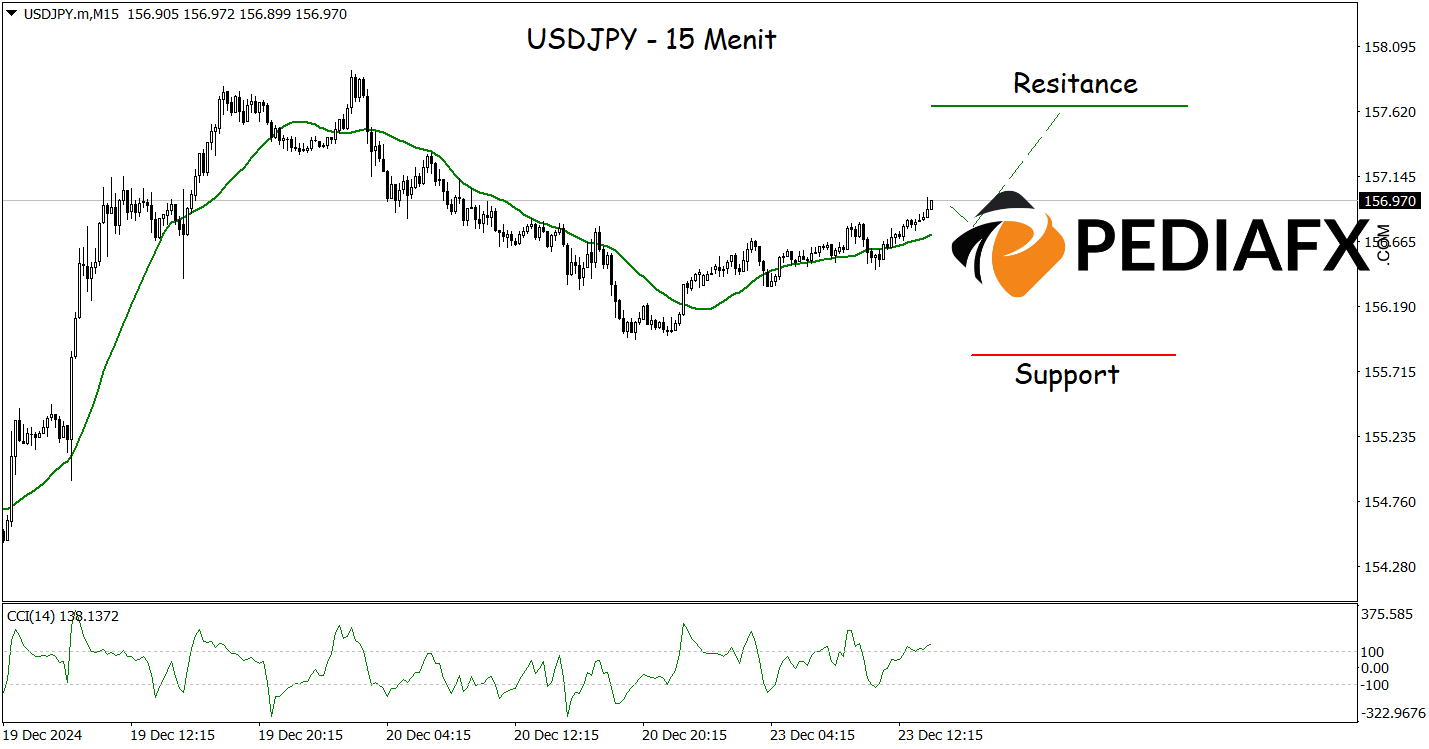

Similarly, the analysis from the hourly chart reinforces this prediction. The 15-minute chart also indicates a bullish opportunity, as the MA trends upwards while the CCI shows signs of being able to rebound from the oversold area, adding to the potential rise of USDJPY. If the scenario unfolds as expected, USDJPY could test the resistance level at 157.680.

Technical Reference: buy while above 155.810

Potential Take Profit 1: 157.300

Potential Take Profit 2: 157.680

Potential Stop Loss 1: 156.155

Potential Stop Loss 2: 155.810