The USDJPY currency pair is currently experiencing an upward movement, indicating a robust uptrend supported by a bullish channel that continuously propels price action higher. Over recent trading sessions, USDJPY has managed to maintain its positive momentum, with technical analysis revealing a significant potential for further gains.

The Moving Average (MA) indicator clearly signals a bullish trend, with the moving averages situated below the current price. This scenario emphasizes the prevailing uptrend, instilling confidence among traders to adopt buy positions. Furthermore, the Stochastic indicator also reflects optimistic signals, showing values in the oversold region and beginning to trend upwards. This suggests a strong likelihood of prices moving higher in the near term.

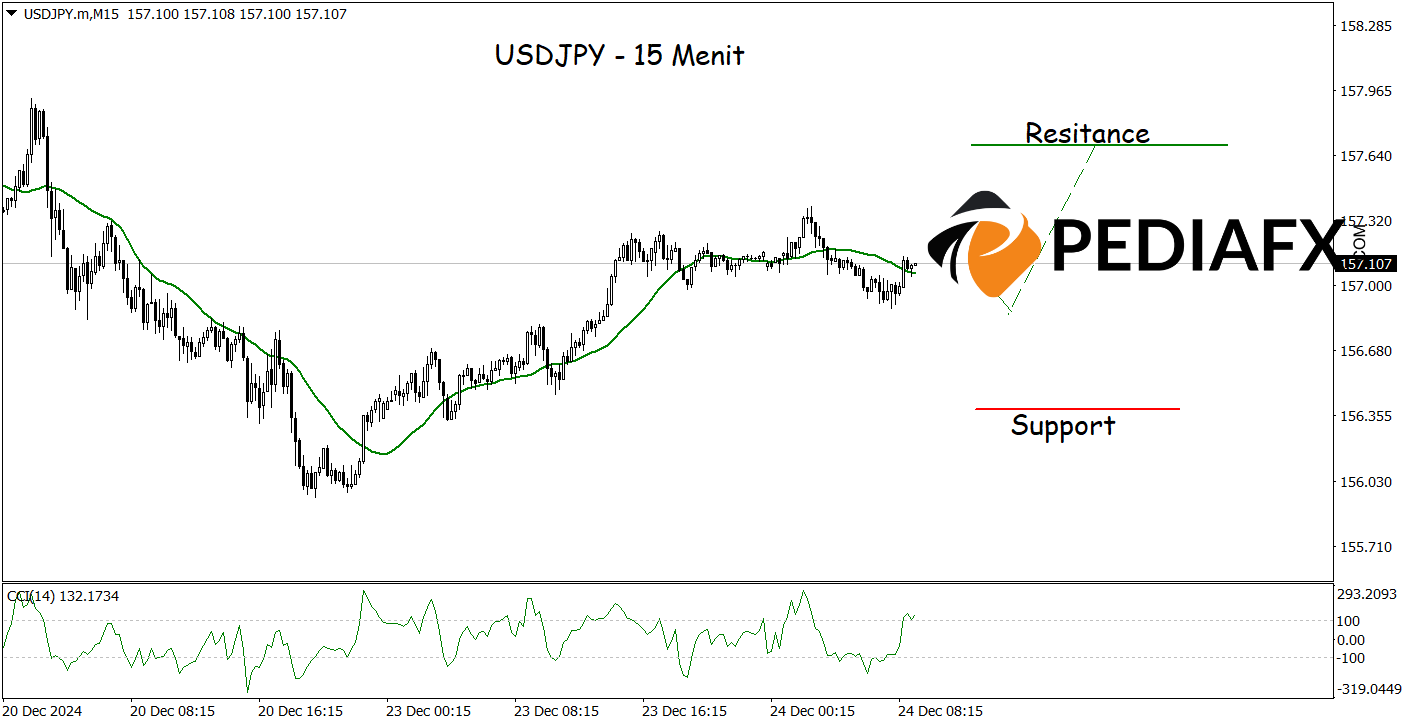

Aligned with the one-hour chart analysis, the 15-minute chart presented above also indicates a potential for price increases as the MA trends upward while the Commodity Channel Index (CCI) exhibits a rebound from the oversold zone, further enhancing the upside potential for USDJPY. Should this scenario unfold, there is a chance for USDJPY to rise and test the resistance level of 157.680.

Technical Reference: buy when above 156.365

Potential Take Profit Level 1: 157.460

Potential Take Profit Level 2: 157.680

Potential Stop Loss Level 1: 156.660

Potential Stop Loss Level 2: 156.365