According to the technical overview of the European markets, GBPUSD has experienced a downturn, continuing to face selling pressure after a 突破 below the crucial 支援 level. The Moving Average (MA) indicator with a 24-period setting reinforces the 看跌的 signal, as it trends downward. This suggests a dominating selling pressure within the short-term trend.

Additionally, the MACD indicator supports the 看跌的 sentiment, with its signal line positioned beneath the zero mark and the histogram reflecting negative momentum. The recent 突破 has been followed by a 拉回 towards the 反抗 area, creating opportunities for market participants to sell.

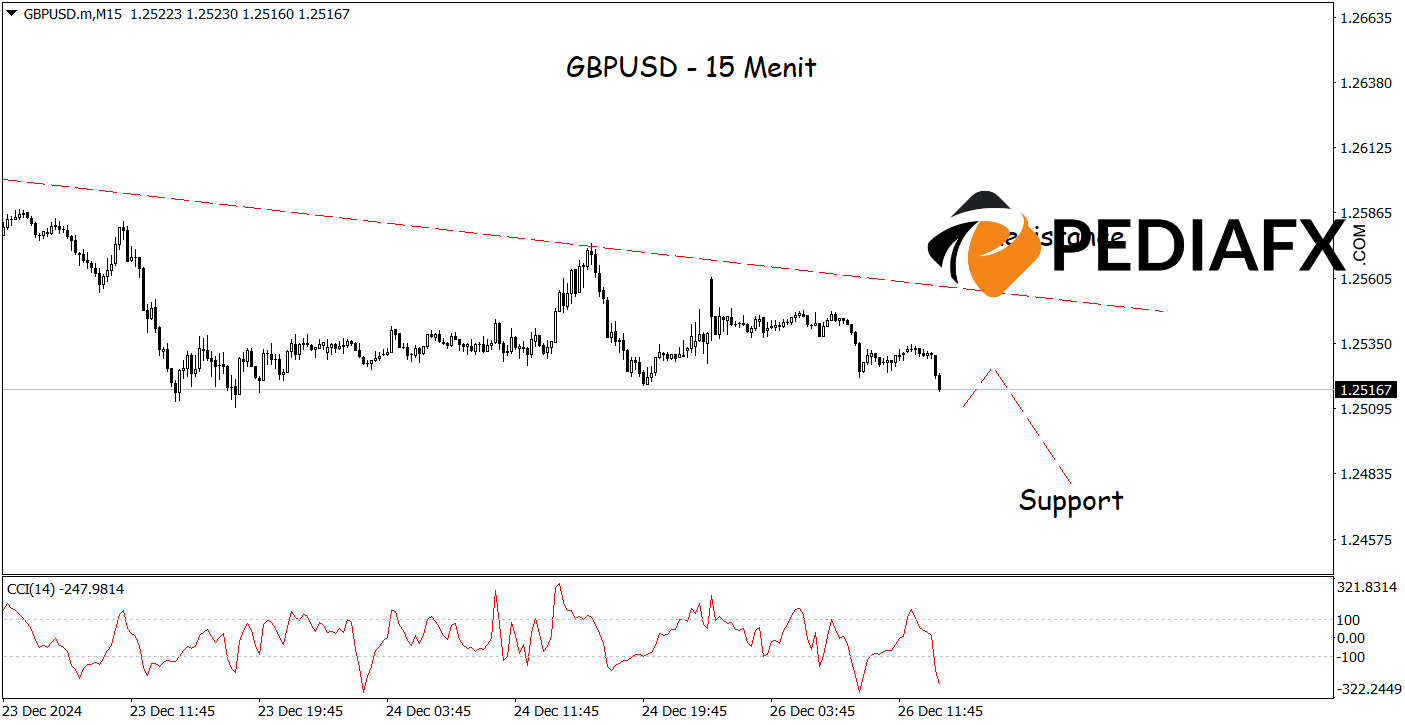

In alignment with the hourly chart analysis above, the 15-minute chart for GBPUSD also presents a bearish outlook. The Stochastic CCI indicator indicates strong 看跌的 conditions, signaling a downward momentum. This positions GBPUSD for a potential decline towards the 支援 level of 1.24780.

Technical Reference: Sell while below 1.25700

Potential Stop Loss 1: 1.25565

Potential Stop Loss 2: 1.25700

Potential Take Profit 1: 1.24950

Potential Take Profit 2: 1.24780