The GBPUSD currency pair continues to maintain a solid uptrend structure on the hourly chart, reflecting the persistent strength of buyers in the market. The price consistently forming higher highs and higher lows indicates that buying pressure remains in control of the price movements. Corrections appear limited as long as this pattern remains intact. This situation keeps the potential for GBPUSD to rise in the short term.

From a technical perspective, the bullish tendency is reinforced by the rising Moving Average and the ZigZag indicator, which continues to uphold the uptrend pattern. The CCI indicator, which is beginning to rise from the oversold region, suggests a resurgence of buying momentum in the market. This combination of signals provides additional confirmation that the bullish bias for GBPUSD is still valid.

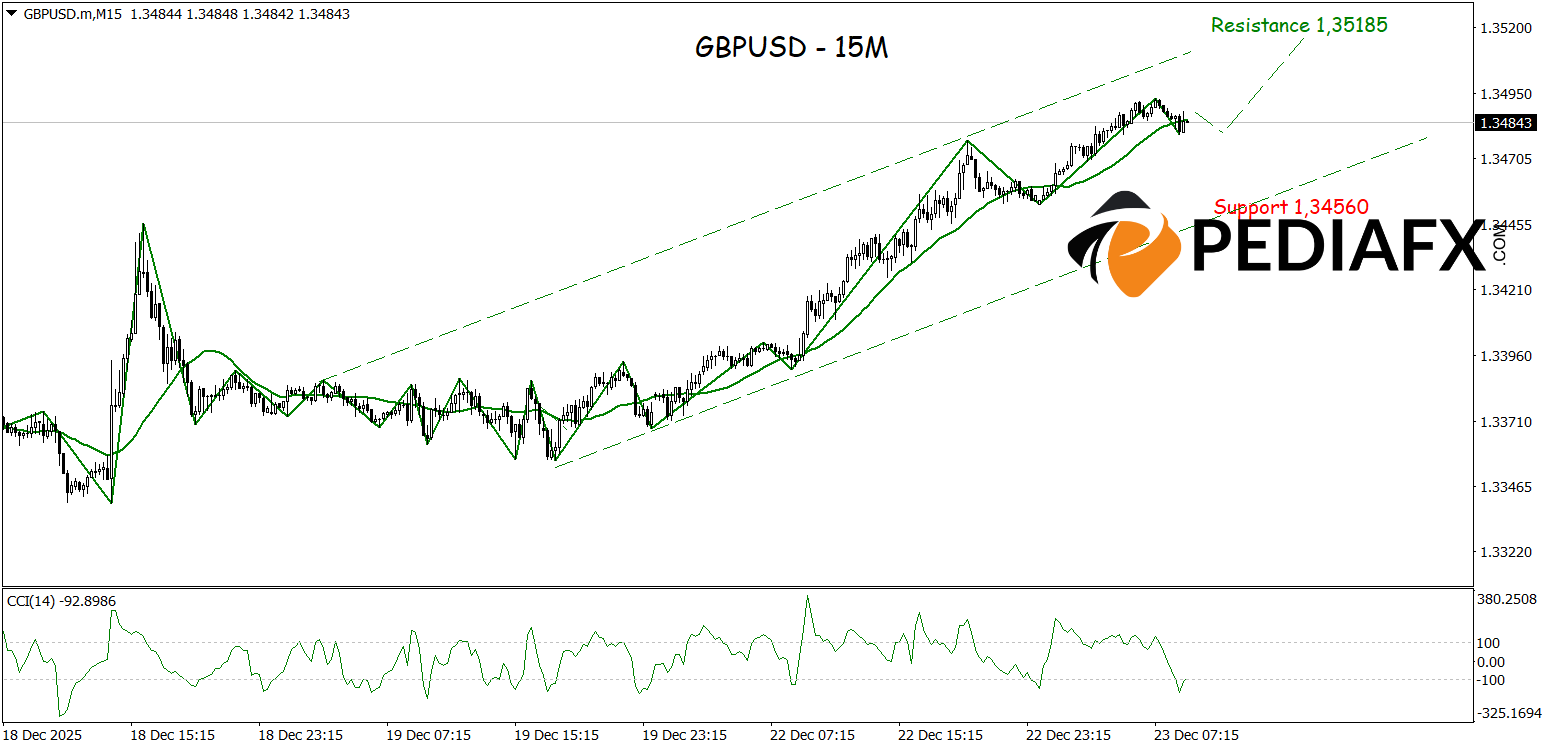

Meanwhile, on the 15-minute timeframe, GBPUSD is also showing positive signals with a consistent structure of higher highs and higher lows. The ZigZag indicator moving in a bullish direction, coupled with the steadily rising Moving Average, emphasizes that buyers are dominating intraday movements. Supported by the CCI in the oversold area, GBPUSD has the opportunity to continue strengthening and test the resistance zone at 1.35185.

技术参考: 买 above 1.34560

潜在的 获利 1: 1.35070

潜在的 获利 2: 1.35195

潜在的 止损 1: 1.34665

潜在的 止损 2: 1.34560