Gold continues to exhibit remarkable resilience, maintaining its position within key 反抗 areas consistently. The dominance of 买家 is evident from the price structure, which continually forms the pattern of 更高的高峰——更高的低谷 (HH–HL). This structure indicates that buying pressure is firmly controlling the market, keeping prices within a 看涨通道. Consequently, any corrections are likely to be viewed as buying opportunities rather than signs of a reversal.

From a technical perspective, the prospects for further increases in Gold are reinforced by several significant indicators. The upward trajectory of the Moving Average confirms that the ongoing positive trend remains intact, while the ZigZag pattern reveals a series of 摇摆 movements continually contributing to the 上升趋势. Additionally, the MACD, positioned in the positive range, signals that the 看涨 momentum is still preserved. Together, these factors solidify the predominant potential for 购买 Gold, as long as prices remain within the established 看涨通道.

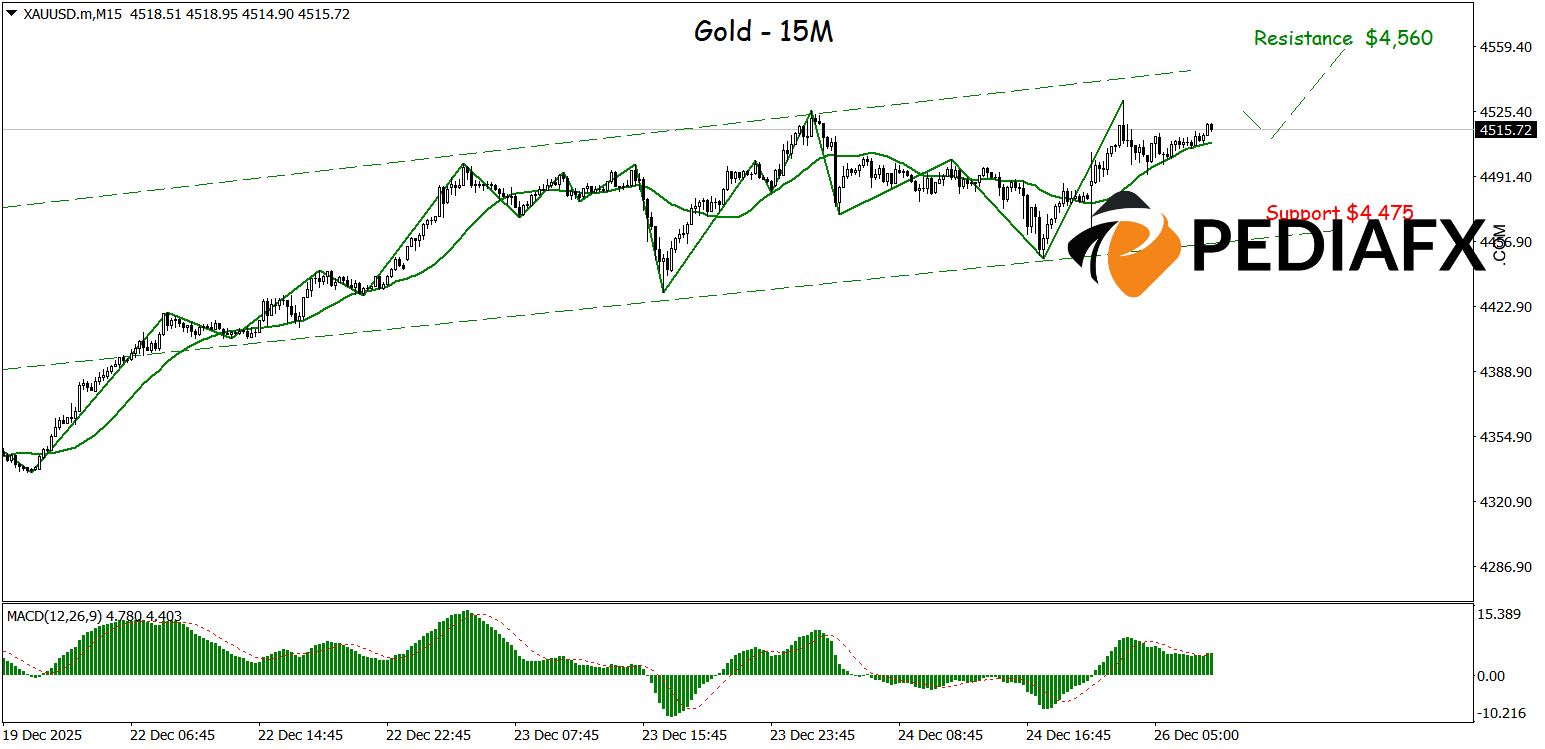

On the 15-minute chart, Gold continues to present a potential for further 看涨 movement as the technical structure remains supportive of upward action. The upward direction of the Moving Average (MA) suggests that the short-term trend remains positive, bolstered by ZigZag formations illustrating a bullish pattern, while the MACD stays in positive territory, indicating sustained buying momentum. Given these conditions, Gold is currently testing the closest 反抗 level at approximately $4,560. As long as prices can stay above the 日内支持 level, the likelihood of continued gains remains feasible.

技术参考: 买 while above 4,475

潜在的 获利 Level 1: 4,540

潜在的 获利 Level 2: 4,560

潜在的 止损 Level 1: 4,492

潜在的 止损 Level 2: 4,475