Menurut technical analysis overview for Europe, USDJPY is on an upward trajectory and continues to indicate potential for further gains as it remains within a bullish channel. This trend is further supported by key technical indicators, namely the Moving Average (MA) and the MACD (Moving Average Convergence Divergence), which both signal a positive outlook.

The MA indicator shows prices trading above the moving average line, suggesting that the kenaikkan harga momentum is still prevalent. Additionally, the MACD reinforces this optimistic trend with its line positioned above the signal line, while the histogram remains in the positive territory.

Disyorkan

Disyorkan

Disyorkan

Disyorkan

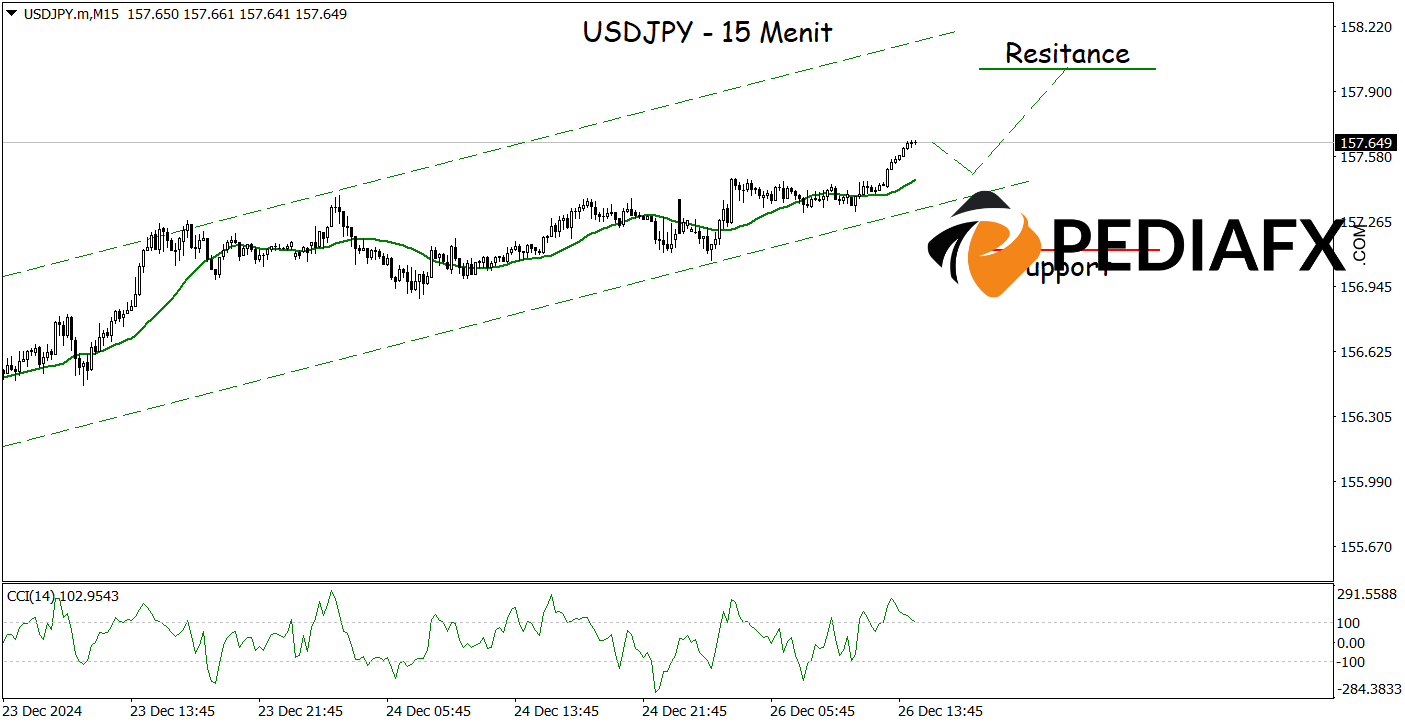

Consistent with the analysis observed on the one-hour chart, the 15-minute chart also presents an upward opportunity as prices are currently situated within a saluran kenaikan harga. The CCI has notably rebounded from an terlebih jual area, further enhancing the potential rise of USDJPY. If the scenario unfolds as anticipated, USDJPY could rise to test the rintangan level at 157.820.

Rujukan Teknikal: beli as long as it stays above 158.000

Potensi Ambil Untung 1: 157.880

Potensi Ambil Untung 2: 158.000

Potensi Hentikan Kehilangan 1: 157.300

Potensi Hentikan Kehilangan 2: 157.140