On the hourly chart, the Nasdaq continues to exhibit a strong upward trend, maintaining its position within a saluran kenaikan harga. The ongoing pattern of forming tertinggi yang lebih tinggi (HH) dan rendah yang lebih tinggi (HL) reinforces that the strength of pembeli continues to be the primary force in the market. As long as prices remain above the lower boundary of the saluran, any weakness observed is likely to be technical in nature and does not pose a threat to the overall trend direction.

From a technical perspective, the upward-sloping Moving Average (MA) serves as a key support for the positive trend of the Nasdaq, in alignment with the ZigZag indicator that maintains the aliran menaik structure. Furthermore, the MACD, positioned in the positive zone, indicates that the bullish momentum remains intact. The combination of these indicators provides the Nasdaq with the opportunity to continue its upward movement and approach the nearest rintangan zone in the near future.

Disyorkan

Disyorkan

Disyorkan

Disyorkan

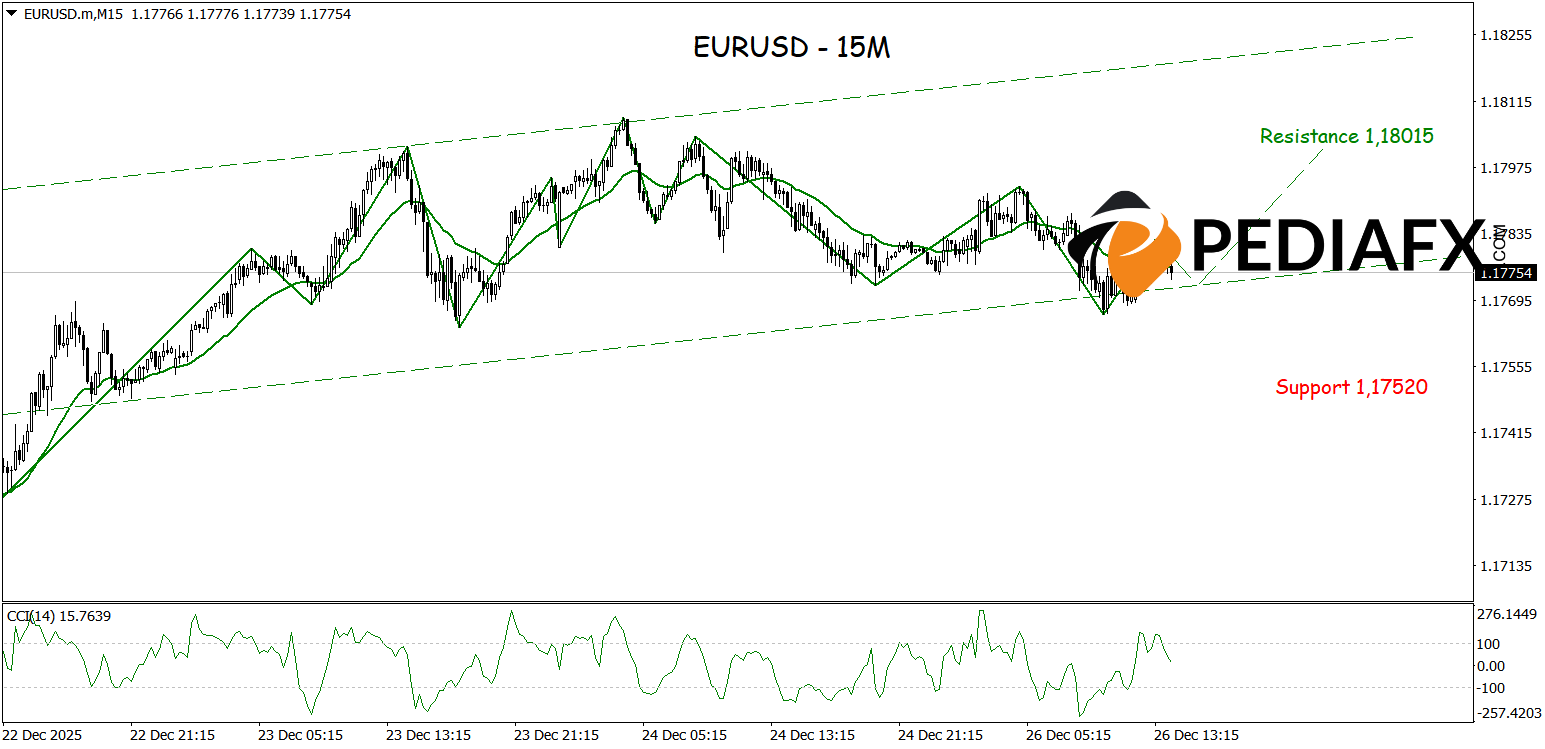

On the 15-minute chart, the Nasdaq displays an acceleration of bullish momentum after successfully breaking through the rintangan saluran menurun and initiating the formation of a new saluran kenaikan harga. This situation reflects a return to buyer dominance in the short term, bolstered by the CCI rebounding from the oversold area, signaling an initial continuation of the price rise. As long as buying pressure persists, there is potential for Nasdaq to strengthen further and test the rintangan at the 25,995 level.

Rujukan Teknikal: beli while above 25,775

Potensi Ambil Untung 1: 25,955

Potensi Ambil Untung 2: 25,995

Potensi Hentikan Kehilangan 1: 25,820

Potensi Hentikan Kehilangan 2: 25,775