On the hourly chart, the Nasdaq continues to exhibit a strong upward trend, maintaining its position within a saluran bullish. The ongoing pattern of forming lebih tinggi lebih tinggi (HH) dan lebih tinggi rendah (HL) reinforces that the strength of pembeli continues to be the primary force in the market. As long as prices remain above the lower boundary of the saluran, any weakness observed is likely to be technical in nature and does not pose a threat to the overall trend direction.

From a technical perspective, the upward-sloping Moving Average (MA) serves as a key support for the positive trend of the Nasdaq, in alignment with the ZigZag indicator that maintains the tren naik structure. Furthermore, the MACD, positioned in the positive zone, indicates that the bullish momentum remains intact. The combination of these indicators provides the Nasdaq with the opportunity to continue its upward movement and approach the nearest perlawanan zone in the near future.

Direkomendasikan

Direkomendasikan

Direkomendasikan

Direkomendasikan

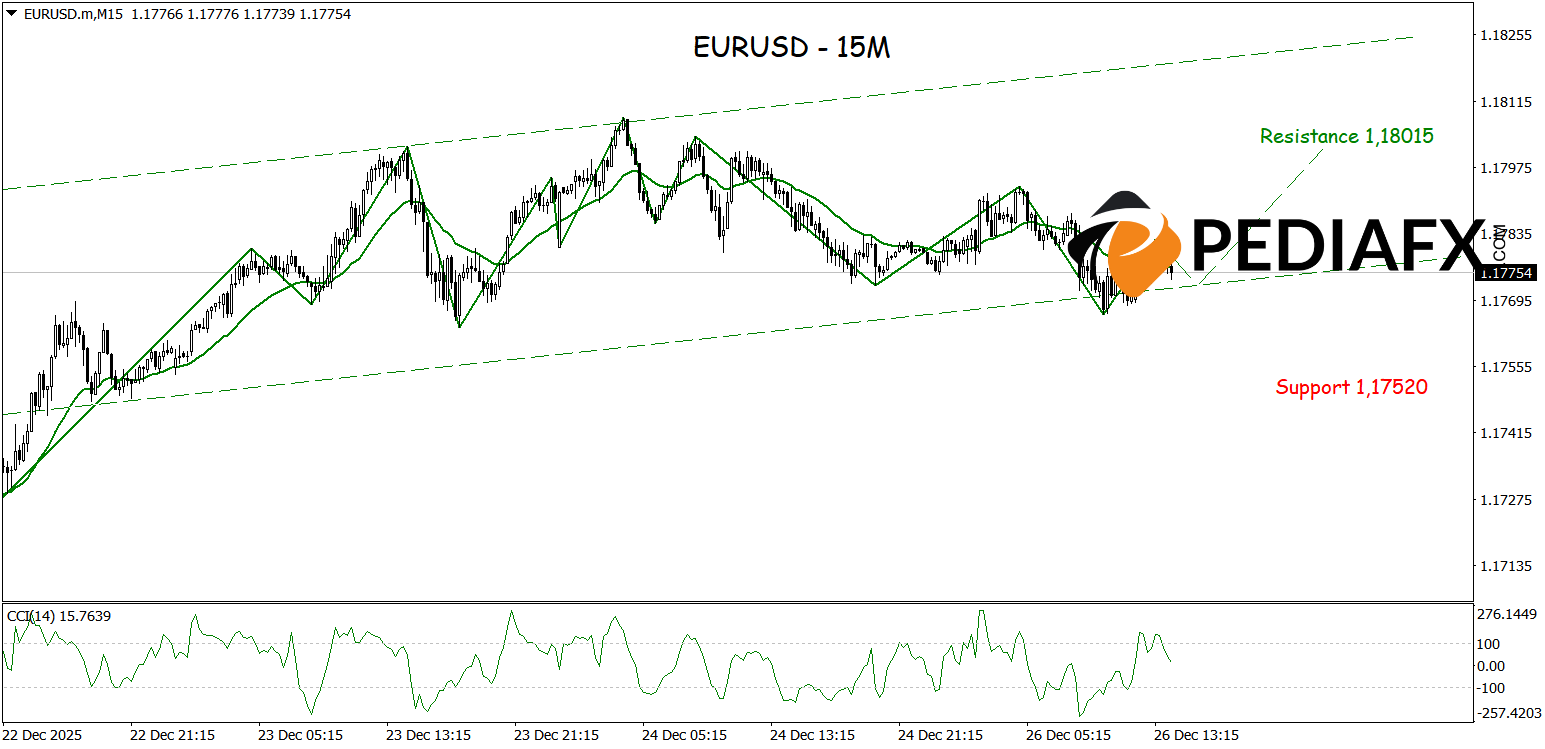

On the 15-minute chart, the Nasdaq displays an acceleration of bullish momentum after successfully breaking through the resistensi saluran bearish and initiating the formation of a new saluran bullish. This situation reflects a return to buyer dominance in the short term, bolstered by the CCI rebounding from the oversold area, signaling an initial continuation of the price rise. As long as buying pressure persists, there is potential for Nasdaq to strengthen further and test the perlawanan at the 25,995 level.

Referensi Teknis: membeli while above 25,775

Potensi Take Profit 1: 25,955

Potensi Take Profit 2: 25,995

Potensi Stop Loss 1: 25,820

Potensi Stop Loss 2: 25,775