The GBPUSD currency pair is currently experiencing intensified selling pressure after successfully breaking through a key mendukung level. This kasar outlook is further validated by signals from the Moving Average (MA) and the MACD (Moving Average Convergence Divergence), both of which indicate the potential for continued downward movement.

The Moving Average indicates that prices are residing below the short-term moving average line, reflecting the dominance of sellers in the market. Meanwhile, the MACD confirms the kasar momentum, with the MACD line trading below the signal line and the histogram showing an increasing depth in the negative territory.

Direkomendasikan

Direkomendasikan

Direkomendasikan

Direkomendasikan

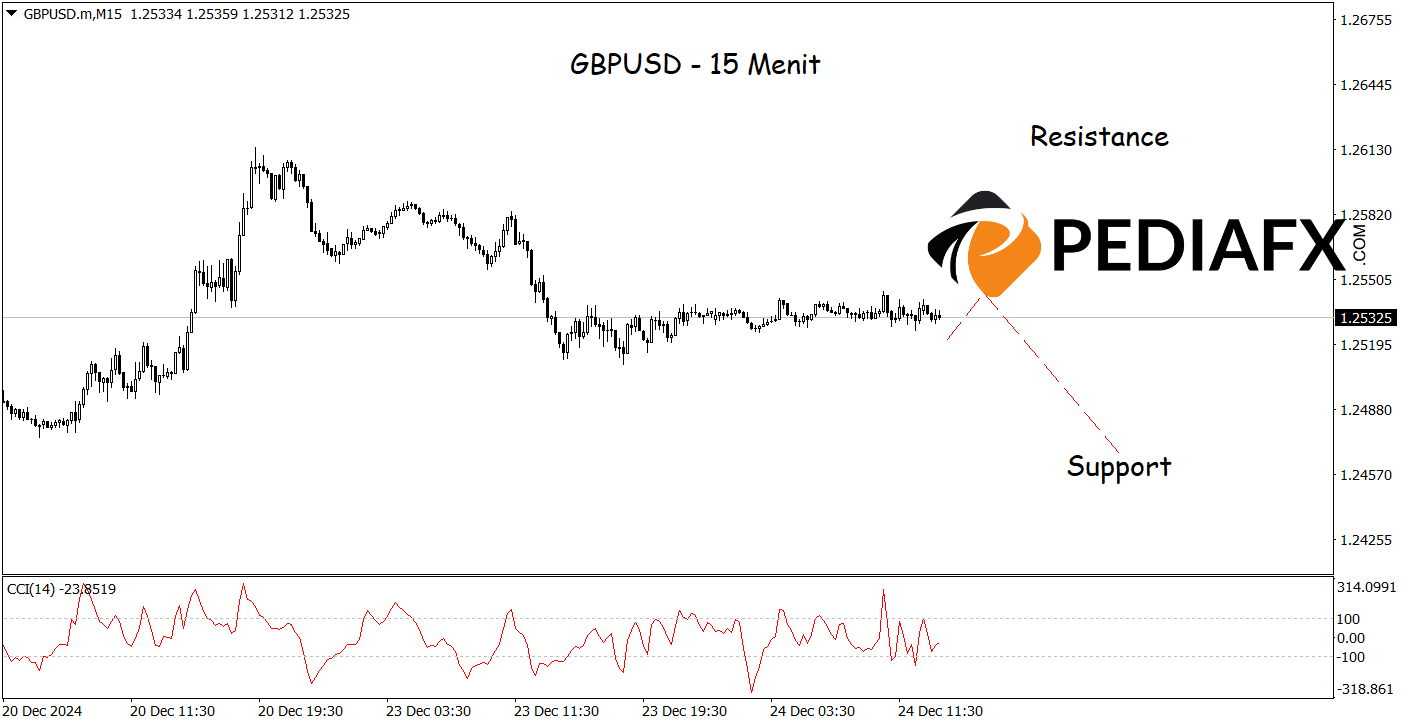

In alignment with the hourly chart analysis above, on the 15-minute chart, GBPUSD also presents kasar opportunities as the Stochastic CCI indicator showed a condition of Strong Bearish, signaling a momentum for decline. GBPUSD has a chance to further drop to the mendukung level at 1.24640.

Referensi Teknis: Menjual sementara di bawah 1.26130

Potensi Hentikan Kerugian 1: 1.25860

Potensi Hentikan Kerugian 2: 1.26130

Potensi Ambil Untung 1: 1.24860

Potensi Ambil Untung 2: 1.24640