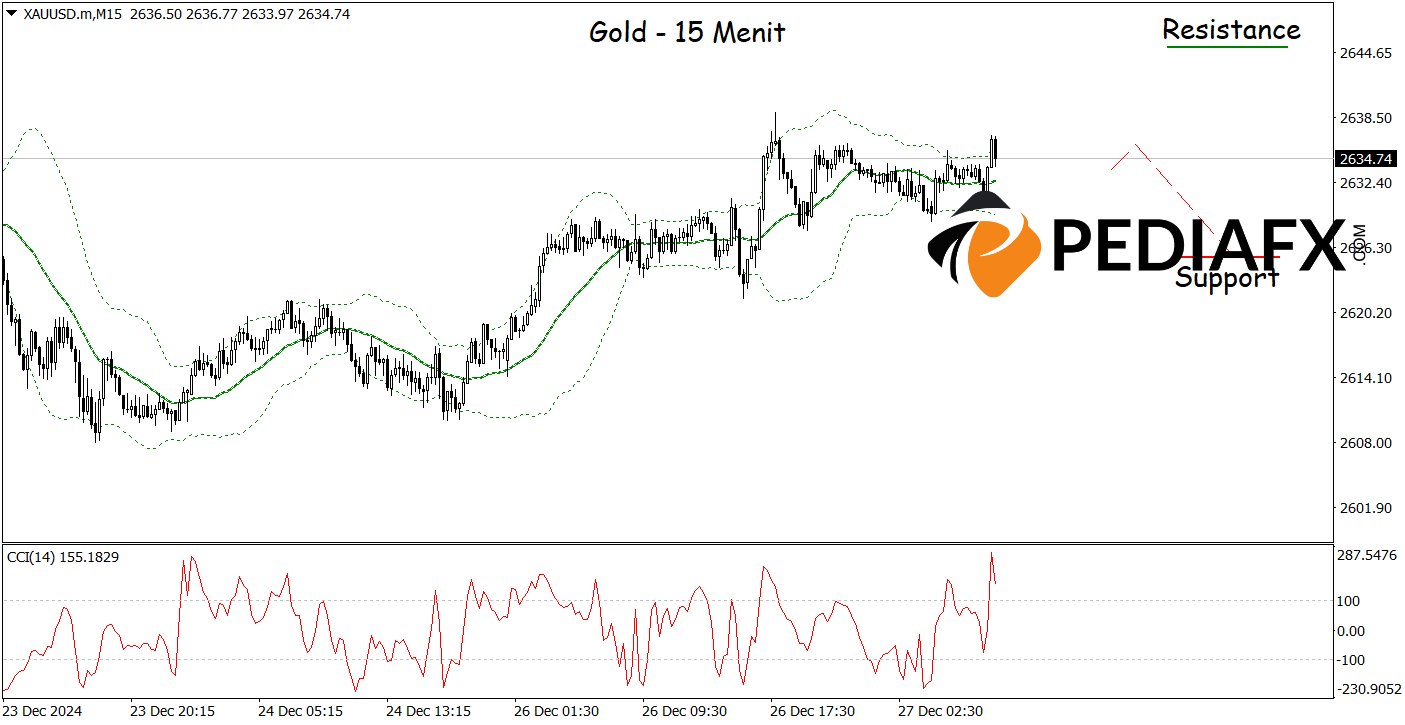

The current Gold price is hovering near the upper limit of the Bollinger Band, suggesting that it is approaching an overbought condition. This scenario is further confirmed by the Stochastic indicator, which is also indicating an overbought status, hinting at a potential price correction in the near future.

From a technical analysis perspective, Bollinger Bands are frequently employed to assess market volatility. When prices reach the upper band, it is common for a trend reversal to occur, moving back towards the middle line as part of the regular price movement pattern. The Stochastic overbought condition reinforces the idea that buying pressure is beginning to wane, paving the way for selling opportunities.

Recommended

Recommended

Recommended

Recommended

On the 15-minute chart, Gold is presenting a bearish signal, as prices have failed to breach the upper boundary of the Bollinger Bands, indicating a selling opportunity. Additionally, the CCI (Commodity Channel Index) is in a state of oversold, adding to the potential for a downward movement. If this scenario unfolds as anticipated, Gold prices might drop to a support level of $2,624.00.

Technical Reference: sell while below 2,645.00

Potential Stop Loss 1: 2,640.00

Potential Stop Loss 2: 2,645.00

Potential Take Profit 1: 2,628.00

Potential Take Profit 2: 2,624.00