The USDJPY pair on the 1-hour chart presents a bullish opportunity following the price’s successful breach of the former bearish trendline that had been a barrier to upward movement. This breakout suggests a weakening of selling pressure and a resurgence of buyer control, thereby creating space for a potential rebound from lower levels. This momentum serves as a significant indicator of the increasing short-term growth potential.

Additionally, technical confirmation bolsters the bullish outlook, as the Moving Average (MA) movement begins to trend upward and the MACD indicator has entered positive territory. Both indicators reinforce the likelihood of the USDJPY rebound continuing, especially if prices can maintain their position above the breakout area. Given this scenario, the prospects for USDJPY growth on the 1-hour time frame appear increasingly robust and worthy of close observation.

Recommended

Recommended

Recommended

Recommended

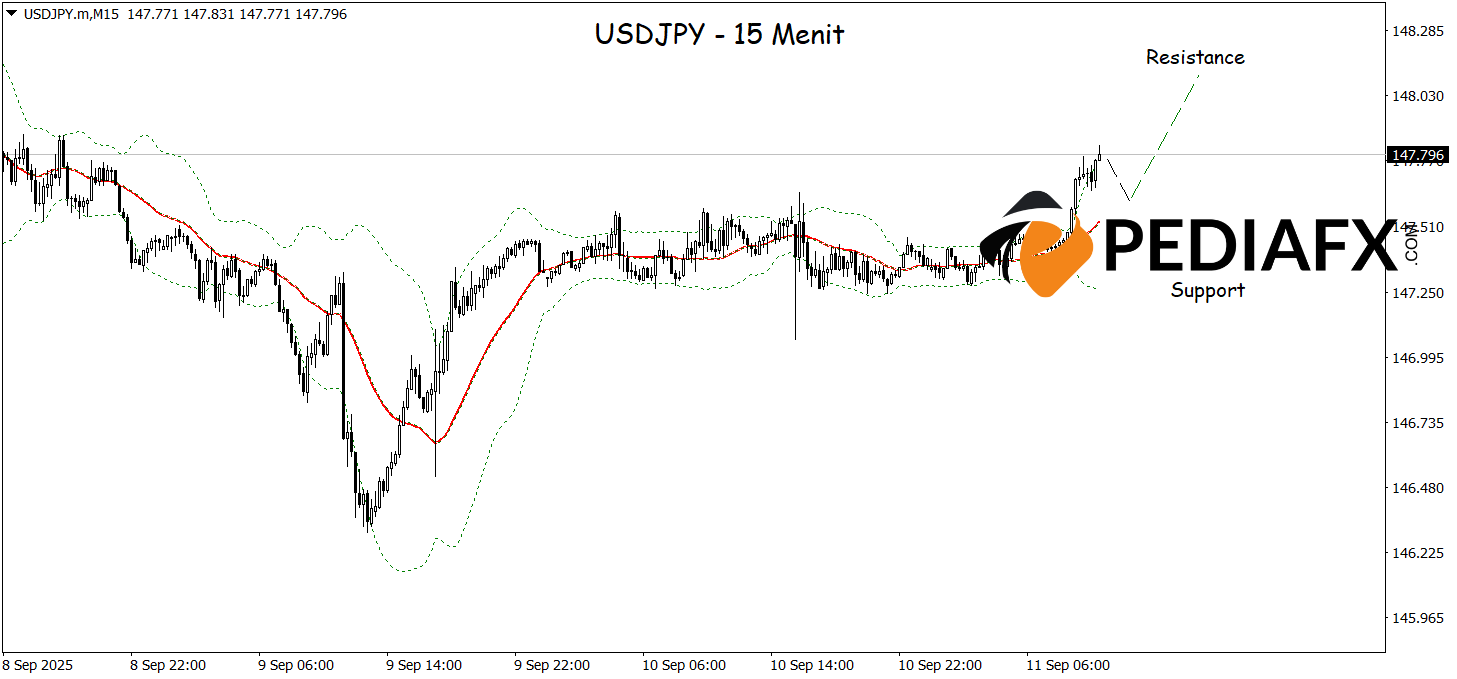

On the 15-minute chart, USDJPY has successfully breached the high point of the resistance offered by the Bollinger Bands (BB), indicating a strong signal that the bullish trend is beginning to take shape. The sharply rising Moving Average (MA) further confirms buyer dominance, creating opportunities for price increases to continue. With this technical combination, USDJPY is positioned for higher movement to test the next resistance level around 148.120.

Technical Reference: Buy while above 147.280

Potential Take Profit 1: 147.970

Potential Take Profit 2: 148.120

Potential Stop Loss 1: 147.445

Potential Stop Loss 2: 147.280