The GBPUSD currency pair is exhibiting signs of weakness after breaking below the bullish channel in the 1-hour time frame. This movement indicates a potential shift in the established uptrend. The break beneath the channel serves as an early signal that buyers are beginning to lose control over the market. Additionally, the Moving Average (MA) line has now positioned itself above the current price, transforming from a support zone into a dynamic resistance level that intensifies bearish pressure.

If the selling pressure persists without a significant recovery in the near term, GBPUSD risks entering a deeper correction phase. Market participants will be closely watching whether the price can maintain itself above critical support levels or continues to decline towards the next technical threshold.

Recommended

Recommended

Recommended

Recommended

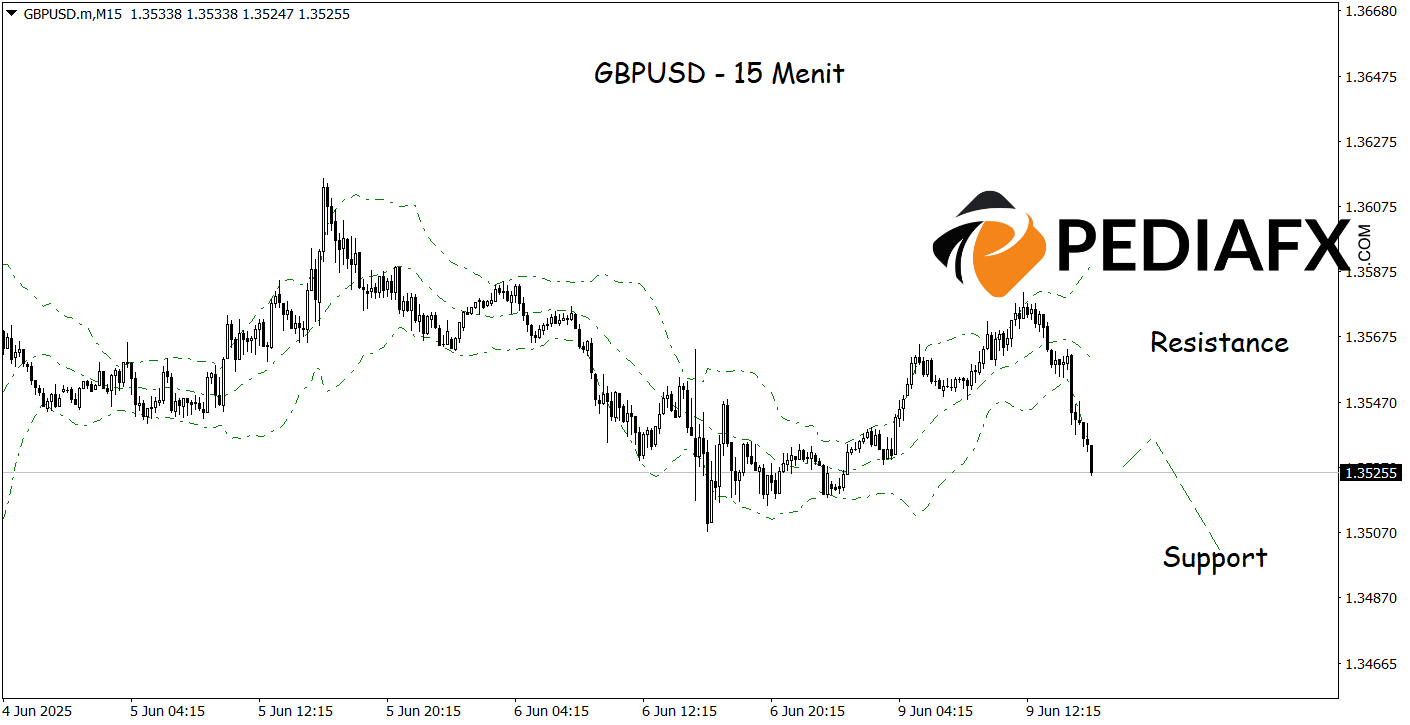

On the 15-minute time frame, GBPUSD has broken below a bearish channel, indicating an ongoing weakening trend in the short term. This break reinforces the previous selling pressure, demonstrating that sellers continue to dominate the market. As long as the price remains below the breakout area without a strong reversal, GBPUSD could continue its downward trajectory toward the 1.35000 level.

Technical References: sell as long as it remains under 1.35600

Potential Stop Loss 1: 1.35490

Potential Stop Loss 2: 1.35600

Potential Take Profit 1: 1.35130

Potential Take Profit 2: 1.35000