The Nasdaq index is currently under scrutiny after the prices were rejected from the upper Bollinger Bands, indicating a potential for further decline in the near future. This event suggests that the upward momentum may be beginning to slow or even reverse into a downturn.

Furthermore, the Stochastic indicator is signaling an oversold condition, implying that the market may have reached an excessive buying level and could be on the verge of further corrections.

Recommended

Recommended

Recommended

Recommended

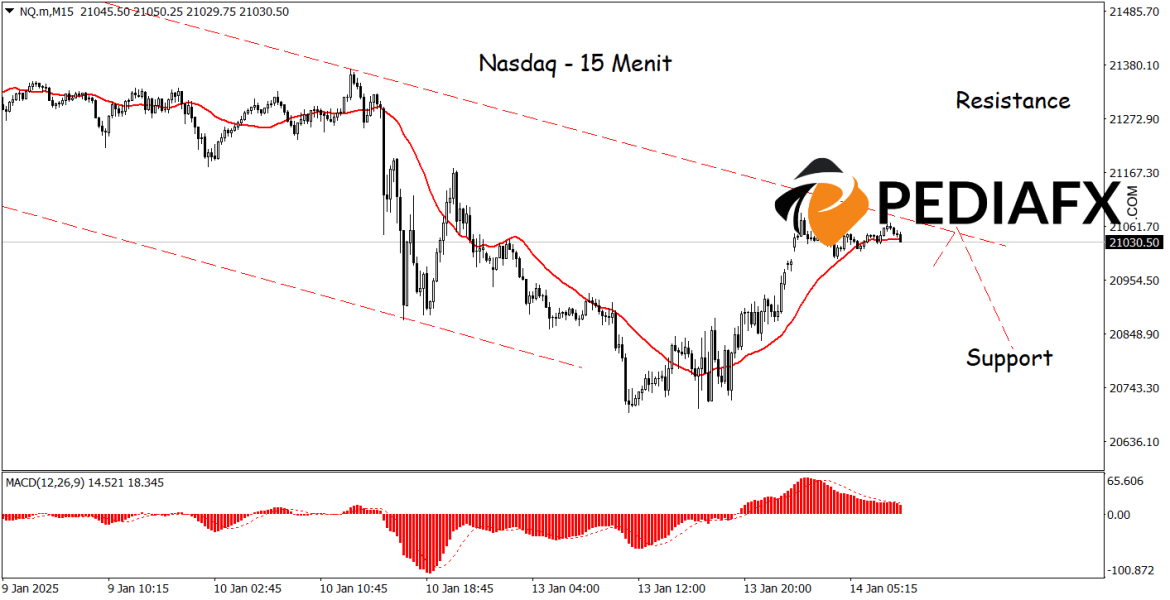

This aligns with the analysis on the hourly chart. The 15-minute chart above also indicates a downward opportunity as prices are currently within a bearish channel and the Moving Average indicator is trending downward, increasing the downward pressure. If the scenario plays out as expected, the Nasdaq may test the support level of 20,820.

Technical Reference: sell while below 21.20

Potential Stop Loss 1: 21,195

Potential Stop Loss 2: 21,260

Potential Take Profit 1: 20,890

Potential Take Profit 2: 20,820