The USDJPY pair is experiencing selling pressure after reaching the upper limit of the Bollinger Bands, indicating a potential downward correction. The price’s failure to break through this resistance level suggests a state of overbought conditions in the market. Moreover, price movements are beginning to reveal a reversal pattern, further enhancing the likelihood of a near-term decline.

At the same time, the Stochastic indicator is signaling an overbought condition. This signal indicates that bullish momentum may be weakening, creating space for stronger selling pressure ahead.

Recommended

Recommended

Recommended

Recommended

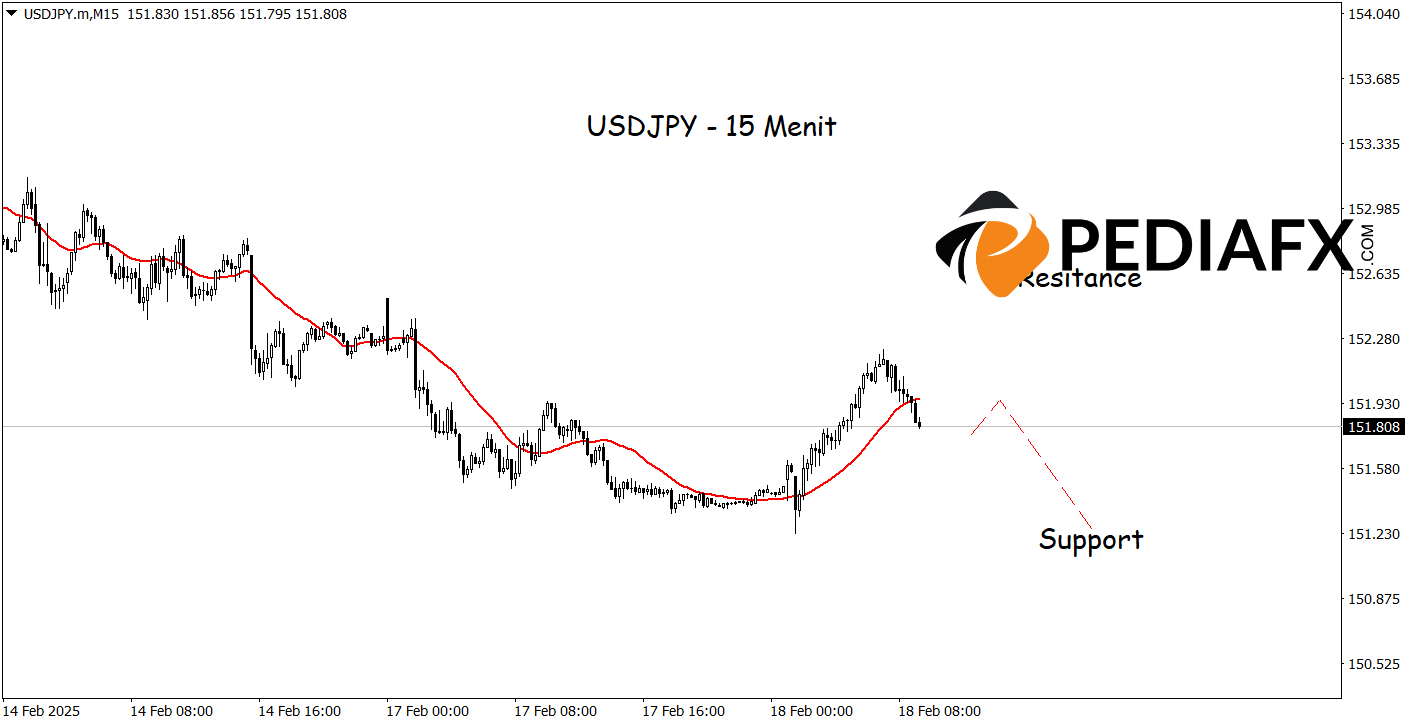

The USDJPY remains under selling pressure on the 15-minute timeframe, with prices trading below the Moving Average (MA), indicating that the bearish trend is still prevailing. The selling pressure has become increasingly evident after the price failed to break through the nearest resistance level and has begun to decline again. Additionally, momentum indicators suggest a weakening trend that could allow USDJPY to test the support level at 151,255.

Technical Reference: sell while below 152,560

Potential Stop Loss 1: 152,345

Potential Stop Loss 2: 152,560

Potential Take Profit 1: 151,480

Potential Take Profit 2: 151,255