The GBPUSD currency pair is currently displaying increasingly robust bearish signals following a significant breakout at key support levels. Recent technical analysis suggests that selling pressure continues to dominate the market, indicating a strong likelihood of further declines ahead.

Moving Average (MA) indicators reveal that the current price is situated below the short-term MA line, reinforcing the notion that the bearish trend remains firmly in place. Additionally, the Stochastic indicator reflects an overbought condition, with values nearing 80. This situation signifies an increased potential for a price reversal, and selling pressure could re-emerge after a potential pullback.

Recommended

Recommended

Recommended

Recommended

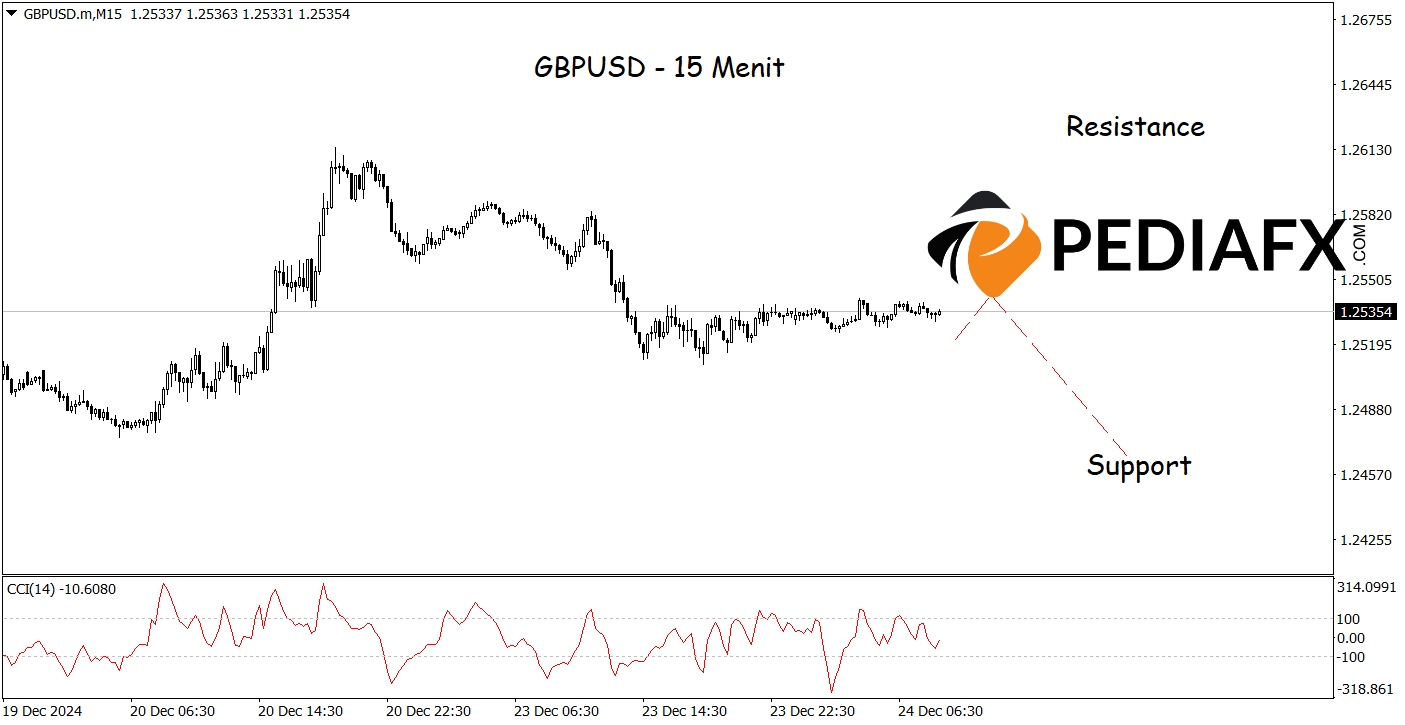

In alignment with the one-hour chart analysis presented above, the 15-minute chart also indicates bearish opportunities, as the CCI Stochastic indicators reveal a bearish condition, which implies the presence of downward momentum. GBPUSD could potentially decline further towards support level 1.24640.

Technical Reference: Sell while below 1.26130

Stop Loss Potential 1: 1.25860

Stop Loss Potential 2: 1.26130

Take Profit Potential 1: 1.24860

Take Profit Potential 2: 1.24640