The GBPUSD currency pair has begun to show signs of a reversal after successfully breaking above the resistance level of the bearish channel on the one-hour timeframe. This breakout serves as a significant signal indicating that the selling pressure that had previously dominated the market is starting to wane, thus creating an opportunity for an upward trend to develop. The Moving Average (MA) is also beginning to trend upwards, further reinforcing the potential for a trend change, suggesting that prices are stabilizing above the previous moving average.

Moreover, the MACD indicator has recently moved into positive territory, signaling that buying momentum is gaining control of the market. The combination of these technical signals suggests that GBPUSD is in a transitional phase from bearish pressure towards a potential short-term bullish trend. As long as prices remain above the breakout area and the MA continues to rise, the likelihood of additional increases towards subsequent resistance levels becomes increasingly probable.

Recommended

Recommended

Recommended

Recommended

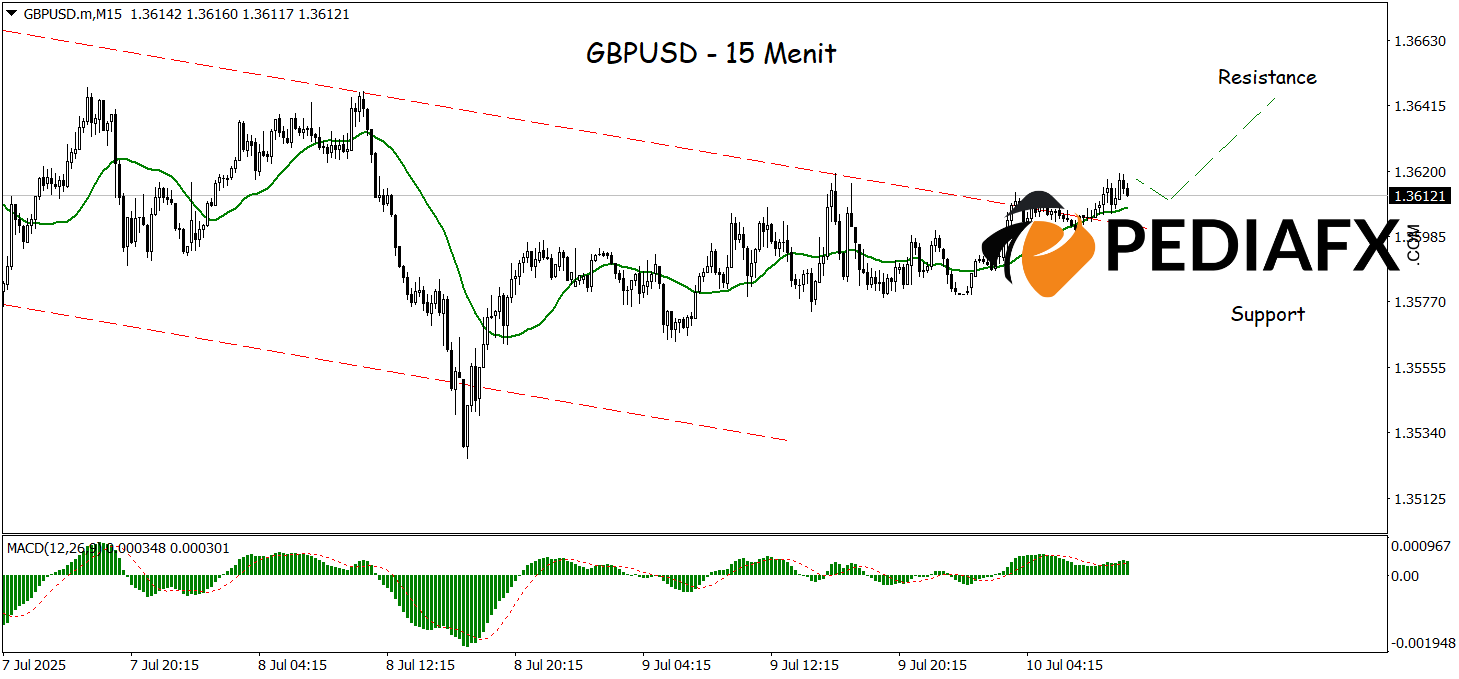

The GBPUSD is also beginning to exhibit upward movement on the 15-minute timeframe, supported by the Moving Average (MA) moving upward, indicating the potential start of a short-term bullish trend. Additionally, the MACD, which is currently in positive territory, strengthens the signal that buying momentum is beginning to establish itself. The combination of these two indicators suggests that buying pressure is starting to dominate the market, opening avenues for GBPUSD to continue its rise toward the next resistance level of 1.36460.

Technical References: Buy if above 1.35750

Potential Take Profit 1: 1.36325

Potential Take Profit 2: 1.36460

Potential Stop Loss 1: 1.35900

Potential Stop Loss 2: 1.35750