The EURUSD currency pair has been exhibiting a stable upward momentum over the past few sessions, consistently forming higher highs and higher lows on the 1-hour timeframe. This bullish trend is significantly supported by a sharply rising Moving Average (MA) line, reflecting the dominance of buyers in the short term. Moreover, the MACD indicator is displaying a positive momentum, with its histogram consistently above the zero line and the MACD line diverging from the signal line. The combination of these indicators reinforces the validity of the ongoing upward trend, creating opportunities for continuation unless there are sudden negative fundamental pressures.

From a technical standpoint, as long as the EURUSD remains above the dynamic support level provided by the nearest MA, there is potential for further gains, targeting the next resistance level. However, traders are advised to closely monitor trading volume and price reactions at these key resistance levels, as profit-taking pressure or upcoming economic data could trigger temporary corrections. Overall, the short-term outlook remains bullish, provided that the trend structure remains intact and is not disrupted by sudden reversals or significant bearish patterns.

Recommended

Recommended

Recommended

Recommended

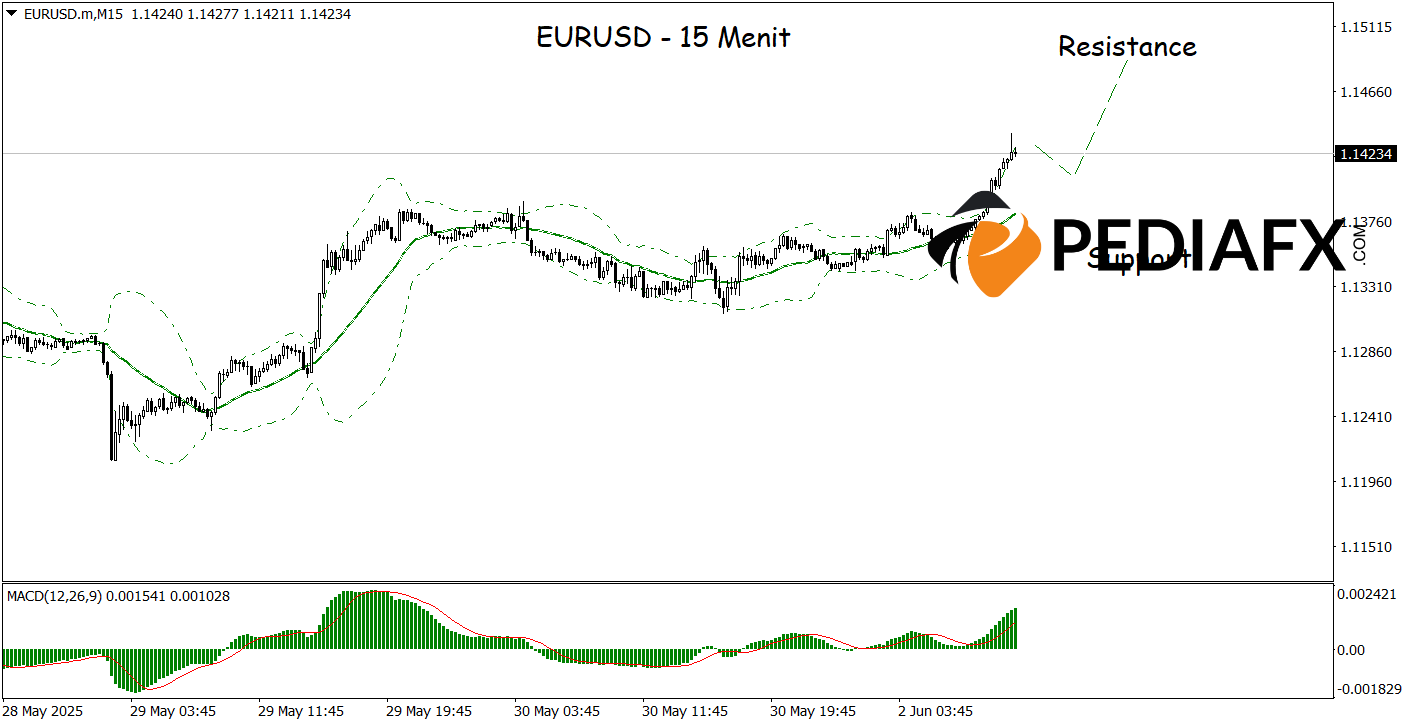

The EURUSD shows potential for continued upward movement after breaking through the upper bands on the 15-minute timeframe, indicating increasing bullish momentum. The technical signals are bolstered by the MACD indicator, which is positioned above both the zero line and the signal line, further supporting the short-term buyer dominance. Stable price movements above the breakout level suggest that buying pressure is likely to continue, testing the level of 1.14875.

Technical Reference: buy while above 1.13570

Potential Take Profit Level 1: 1.14635

Potential Take Profit Level 2: 1.14875

Potential Stop Loss Level 1: 1.13860

Potential Stop Loss Level 2: 1.13570