The EURUSD currency pair continues to experience strong selling pressure on the hourly chart, characterized by a consistent downward price trend. The emergence of Lower High and Lower Low formations observed on the Zigzag indicator reinforces the ongoing dominance of sellers. So far, attempts to strengthen prices have failed to break through significant resistance areas, while the steep inclination of the Moving Average (MA) line further solidifies the short-term bearish bias. This situation suggests that the downward pressure could persist in the near future.

Regarding momentum, the Commodity Channel Index (CCI) positions itself in the overbought territory, which generally serves as an early signal for a potential downward reversal. Should the selling pressure continue, the EURUSD pair may continue to weaken towards the next support level. Traders are advised to remain cautious about potential brief pullbacks, but as long as the price stays below the main MA and the Lower High–Lower Low pattern is maintained, the bearish tendency will likely remain dominant.

Recommended

Recommended

Recommended

Recommended

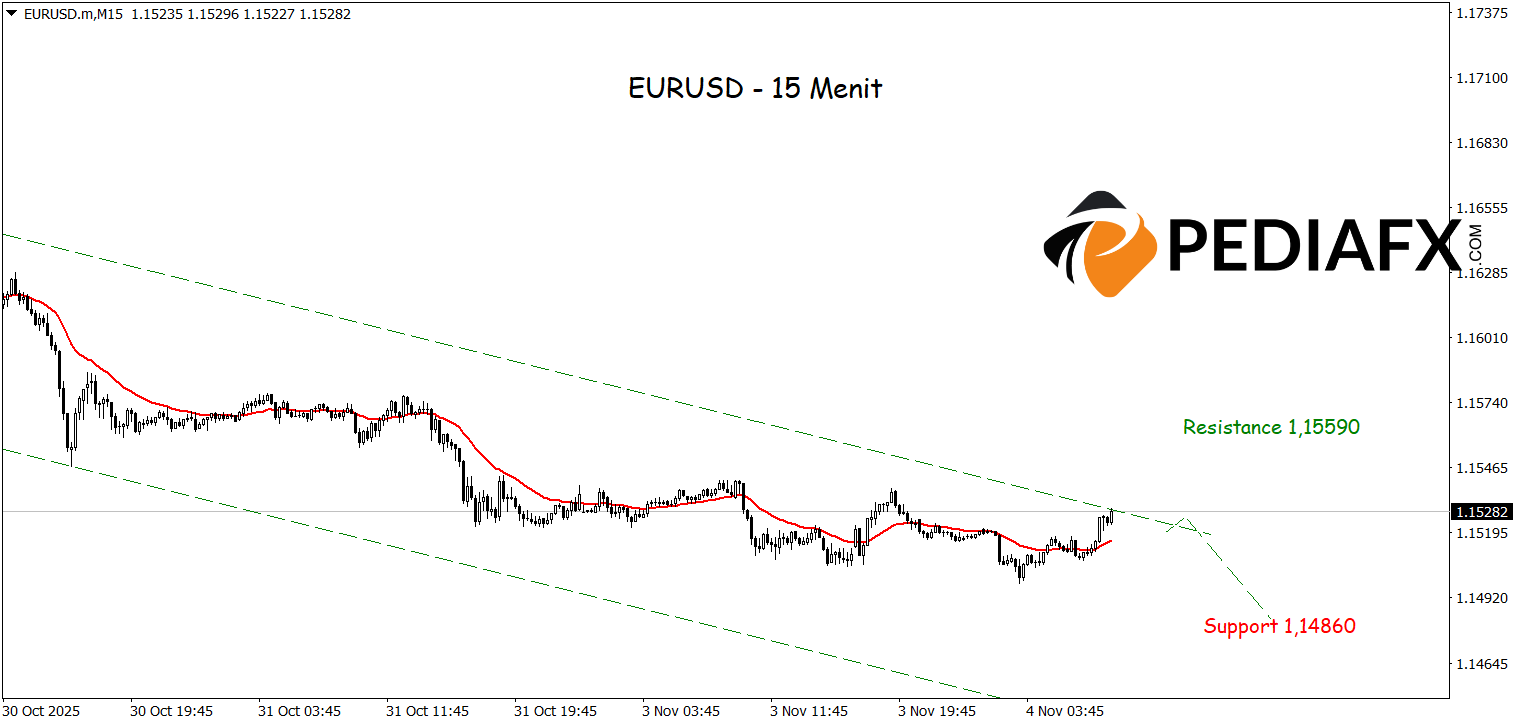

On the 15-minute chart, EURUSD is still trading within a bearish channel, indicating that the likelihood of further declines remains significant. Although the Moving Average (MA) line is beginning to level off slightly, the price direction still reflects the dominance of selling pressure. This condition underscores that sellers continue to control market movements, especially leading into the European session this afternoon, where the currency pair is expected to further weaken and test the support level around 1.14860.

Technical Reference: sell while below 1.15590

Potential Stop Loss 1: 1.15440

Potential Stop Loss 2: 1.15590

Potential Take Profit 1: 1.15000

Potential Take Profit 2: 1.14860