The EURUSD currency pair is currently positioned to extend its downward trend, bolstered by strong bearish signals from the 24-period Moving Average (MA) and the Moving Average Convergence Divergence (MACD) indicators. This analysis provides a clear insight into the price movement direction in the market.

At present, the price is situated below the MA line, indicating a tendency towards a bearish short-term trend. Concurrently, the MACD indicator is also presenting bearish signals. The negative MACD histogram suggests that selling pressure remains prevalent, while the signal line positioned above the MACD line further confirms that the downward trend is likely to persist.

Recommended

Recommended

Recommended

Recommended

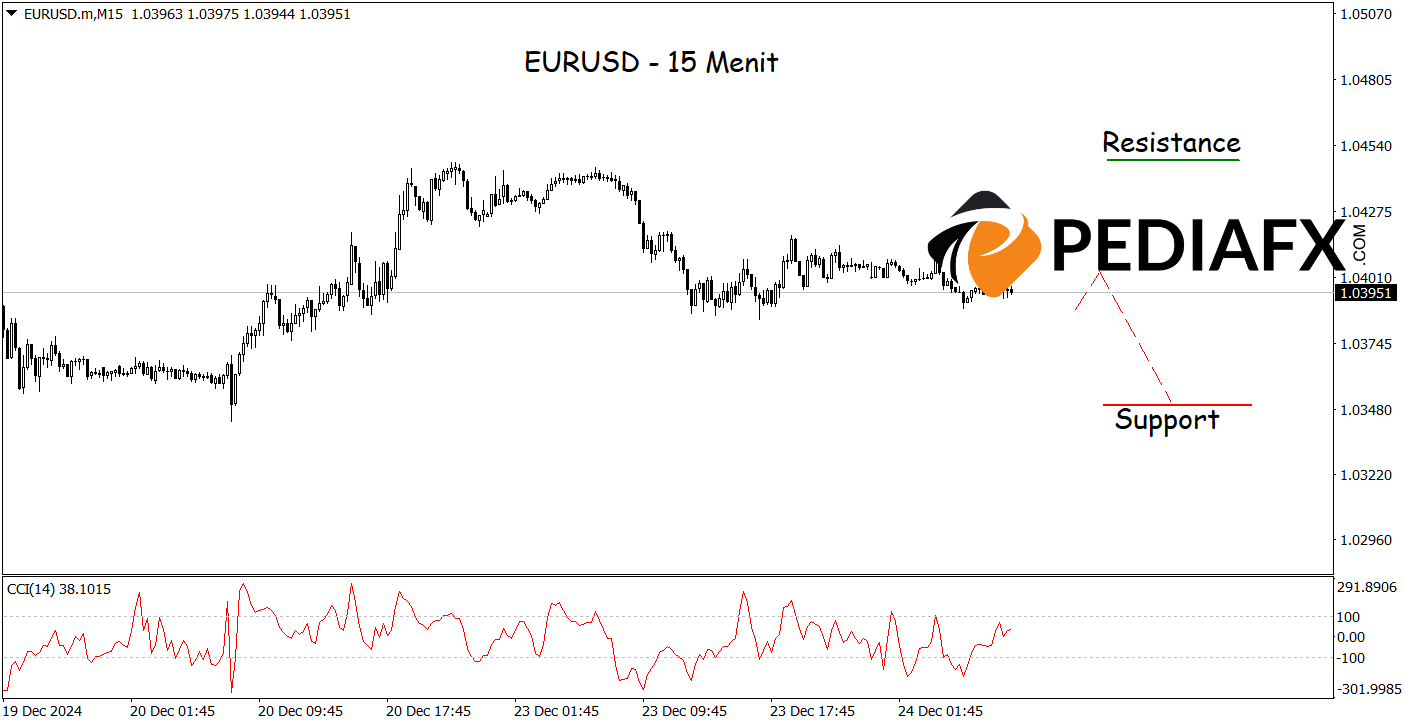

In alignment with the analysis from the one-hour chart, the 15-minute chart for EURUSD also indicates bearish opportunities, as the Commodity Channel Index (CCI) is in an extreme bearish zone. This condition could push EURUSD down towards the support level of 1.03500.

Technical Reference: Sell when below 1.04460

Potential Stop Loss 1: 1.04325

Potential Stop Loss 2: 1.04465

Potential Take Profit 1: 1.03665

Potential Take Profit 2: 1.03500