The EURUSD currency pair is showing signs of a potential decline after being rejected at the upper Bollinger Bands, which often serves as an early indication of a price reversal. The selling pressure is intensifying, supported by key technical indicators such as the Moving Average (MA) and the MACD (Moving Average Convergence Divergence), both of which affirm a bearish outlook.

The Moving Average indicates that the price is trading below its moving average line, clearly signaling a dominant selling pressure. Additionally, the MACD confirms the bearish signal with its line moving below the signal line, and the histogram entering negative territory.

Recommended

Recommended

Recommended

Recommended

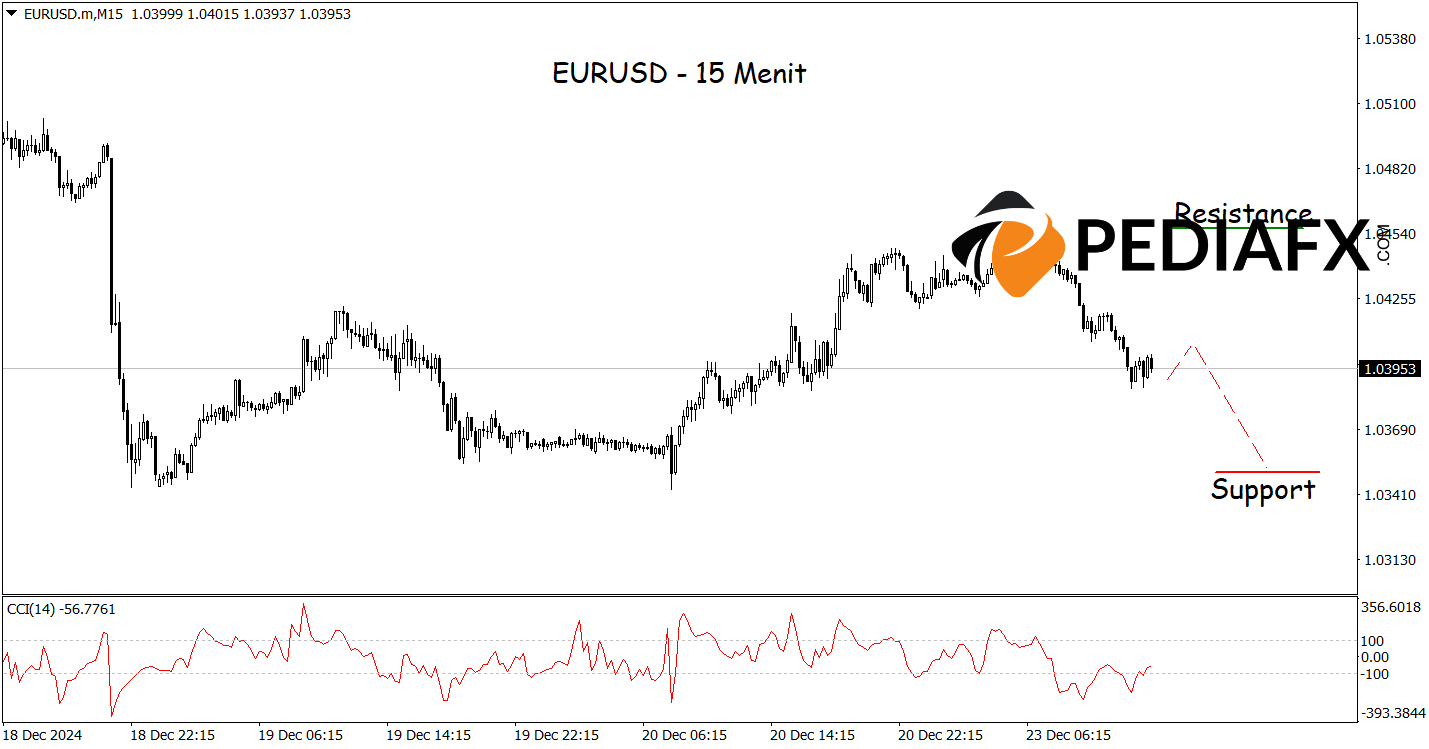

In alignment with the hourly chart analysis, the 15-minute chart of EURUSD is also showing bearish opportunities as the CCI indicator resides in a bearish extreme. This situation could pressure EURUSD down towards the support level of 1.03495.

Technical Reference: sell below 1.04770

Potential Stop Loss 1: 1.04385

Potential Stop Loss 2: 1.04570

Potential Take Profit 1: 1.03665

Potential Take Profit 2: 1.03495