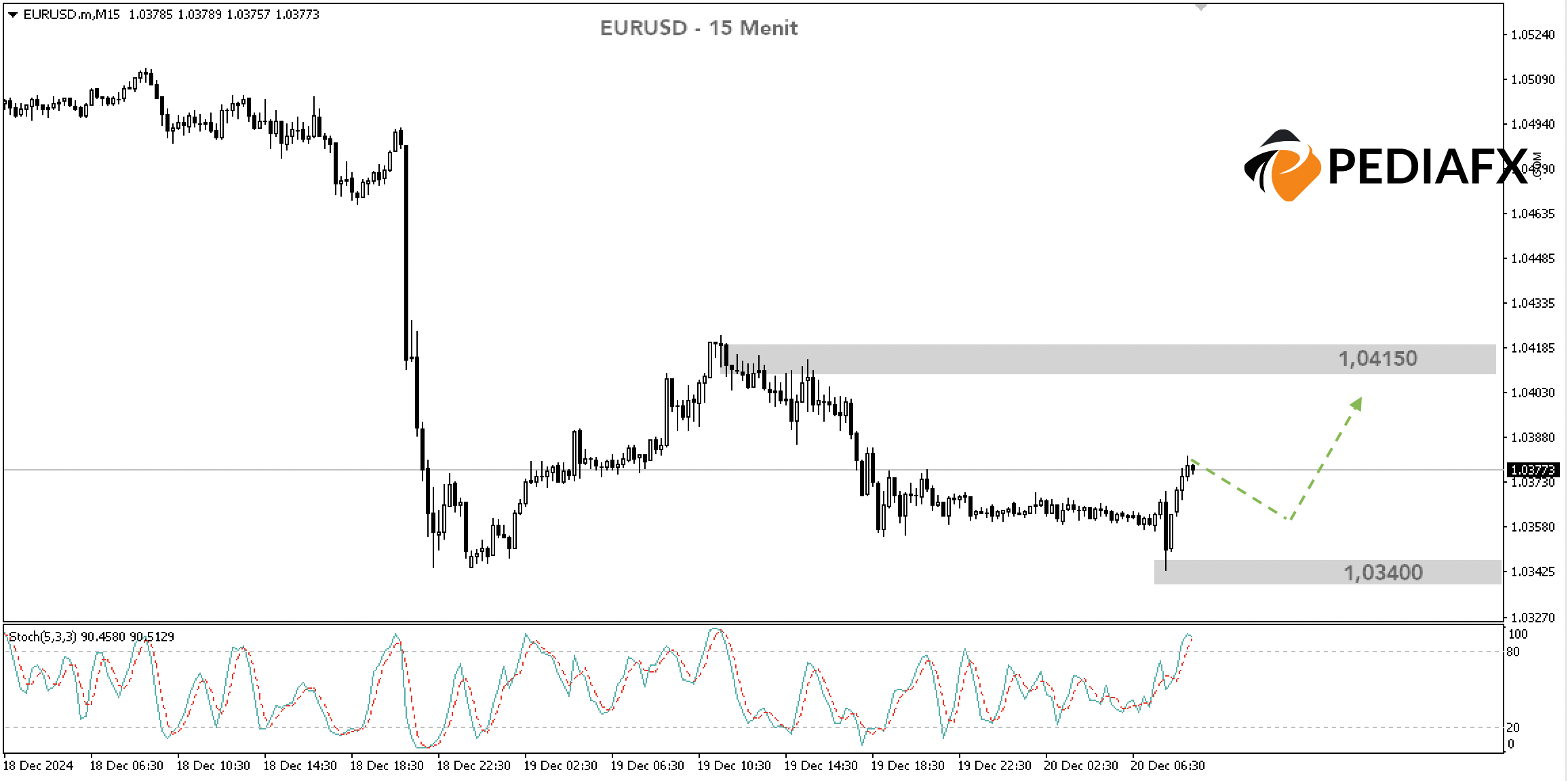

The EURUSD is currently trading near its lowest point in two years following a significant decline last Wednesday. On the 1-hour chart, the pair appears to be forming a Double Bottom pattern, indicating a possibility for upward movement.

The neckline of this pattern is around 1.04150, which serves as the initial target for a potential rise.

Recommended

Recommended

Recommended

Recommended

On the 15-minute chart, the Stochastic indicator is in the overbought zone. This suggests a potential short-term decline for the EURUSD. However, such a drop could also present a buying opportunity with a favorable risk-reward ratio.

As long as it does not break below 1.03400, the EURUSD remains positioned for an increase towards 1.04150.

Technical References: Buy as long as above 1.03400

Potential Take Profit 1: 1.04150

Potential Take Profit 2: 1.04500

Potential Stop Loss 1: 1.03400

Potential Stop Loss 2: 1.03100