The Nasdaq index is showing strong potential for recovery after falling into the مبالغ في البيع region, as indicated by the Stochastic oscillator, and reaching the lower boundary of the Bollinger Bands. These two technical indicators suggest that the selling pressure is starting to lessen, creating an opportunity for the index to reverse its current trend. A rebound from the oversold area typically signals that the market may be oversold, with buyers beginning to step in to establish their positions.

The Bollinger Bands, illustrating price movement towards the lower limit, further bolster this potential reversal. When prices move below the lower Bollinger Band, a corrective movement towards a more balanced area often follows.

مُستَحسَن

مُستَحسَن

مُستَحسَن

مُستَحسَن

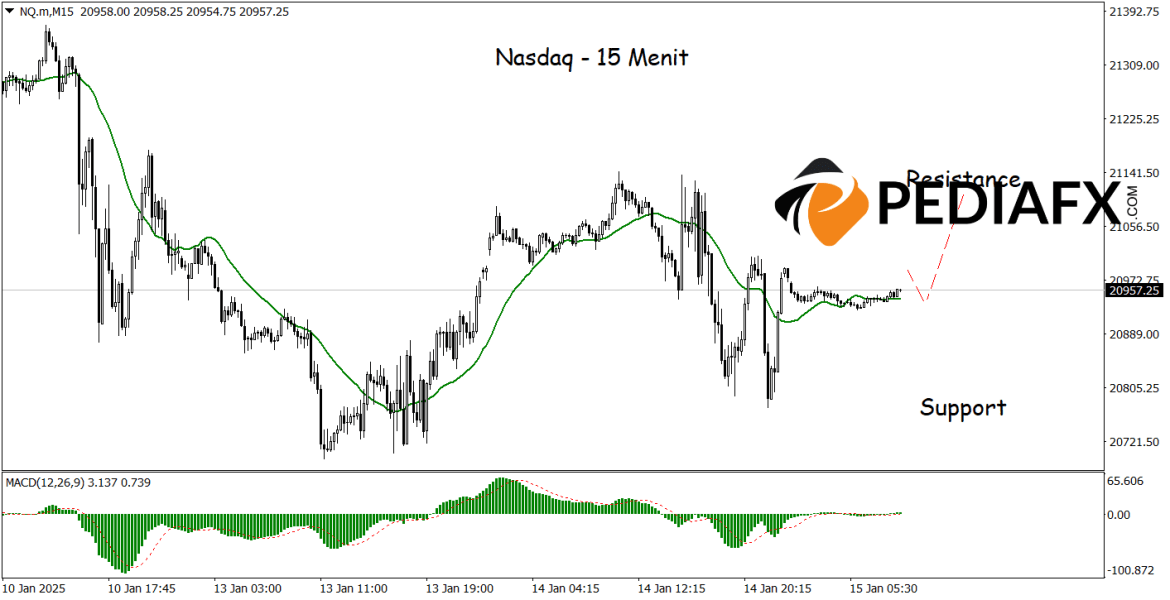

In alignment with the one-hour chart analysis, the 15-minute chart above also displays a buying signal as both the MA and MACD indicate upward movement. If this scenario plays out, the Nasdaq may rise to test the مقاومة level of 21,108.

المرجع الفني: يشتري as long as it stays above 20,795

محتمل جني الأرباح 1: 21,053

محتمل جني الأرباح 2: 21,108

محتمل وقف الخسارة 1: 21,860

محتمل وقف الخسارة 2: 20.795